Natural disaster seasons loom large in the insurance industry, often leaving clients with heightened concern about how their premiums might change in response. The fluctuating landscape of hurricanes, wildfires, floods, and other weather-related events challenges insurers to recalculate risk and recovery costs. Observing these premium shifts offers insight into a careful process that links financial stability, regulatory constraints, and the realities of paying for increasing losses.

The Tide of Claims and Its Ripple Effect

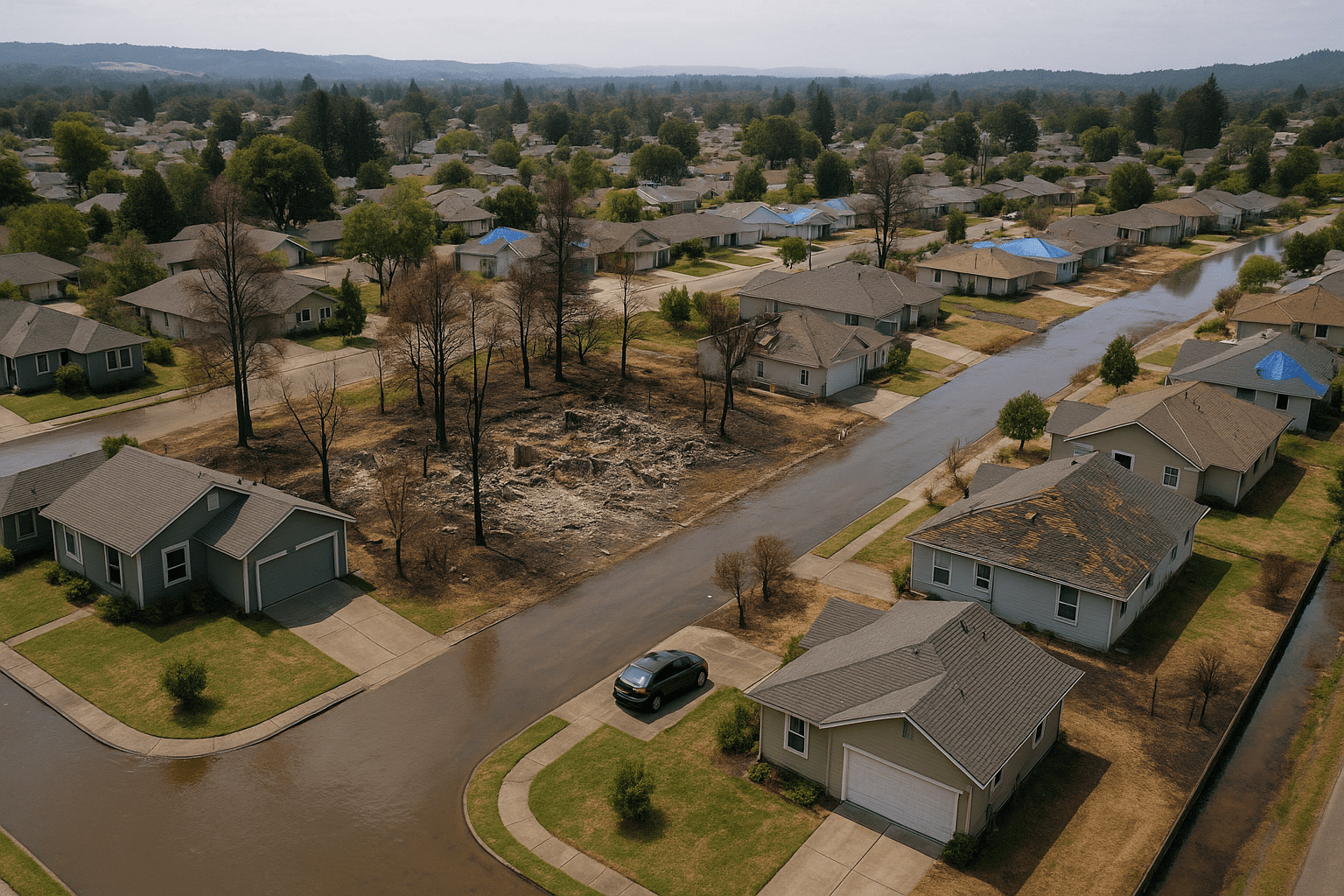

When a season delivers widespread damage, insurers often face a surge in claims payouts. These are not just numbers on a spreadsheet; they represent tangible rebuilding expenses, repair efforts, and, sometimes, long-term economic disruption for policyholders. The immediate response is surprisingly complex. While insurers aim to honor claims promptly, the aggregate costs stretch resources, which inevitably influences how future premiums will be set. This phenomenon can feel deeply personal for individuals watching their bills climb after a year marked by devastating storms or fires.

One critical factor is that each insurer pools risk among its customers, spreading potential financial burdens across many policies and years. However, natural disasters cluster damage both geographically and temporally, challenging the very notion of risk diversification. This clustering means companies may see losses concentrated in certain regions, pushing them toward reconsidering premium rates specifically in those high-risk zones, even if other areas remain unaffected.

Behind the Numbers: How Insurers Calculate New Premiums

Insurers rely on an array of data points when adjusting premiums after a disaster-filled season. Historical claims data plays a significant role, but it’s also about looking forward. Actuarial models incorporate recent events alongside broader trends in climate, population growth in vulnerable areas, and changes in building codes that might affect future damage levels.

Recent years have seen an increased presence of sophisticated predictive analytics. These techniques consider not just the frequency and severity of past disasters, but evolving risks tied to climate change and urban development. For instance, an insurer might revise premium calculations after a wildfire season if models now predict higher risk due to prolonged drought conditions combined with expanding residential areas in fire-prone zones.

Still, these models are not crystal balls. Uncertainty remains, and insurers often build conservatism into their rates to protect against unforeseen losses. This cautious approach can feel frustrating for policyholders who see rates increase immediately following one or two heavy disaster seasons but may benefit, over time, from more stable and balanced pricing as data and experience grow.

The Push and Pull of Regulation and Market Forces

Insurance pricing rarely happens in a vacuum. State insurance departments and regulators often scrutinize premium increases, especially when they follow major disaster seasons. These watchdogs consider whether hikes are justified by actual risk and cost data or if they might unduly burden consumers.

Sometimes, this oversight can delay or limit insurers’ ability to raise premiums, leading companies to seek alternative solutions like tightening underwriting standards or limiting new policy issuance in certain areas. These moves can have their own ripple effects, influencing availability and affordability of coverage just as risks rise.

On the customer side, competitive market dynamics can temper premium increases. Insurers vie for policies, and sudden sharp increases risk driving clients to look elsewhere, if an option exists. This dynamic forces a balancing act: companies need to maintain financial health to pay claims while keeping products attractive enough to retain business in high-risk environments.

Where Deductibles and Coverage Limits Enter the Picture

Adjusting premiums is not the only lever insurers use to manage risk and costs after tough seasons. Changes often include revising deductibles or policy limits. Higher deductibles shift more immediate costs to the insured, making premiums somewhat more affordable but increasing out-of-pocket exposure after a loss.

Adjustments in coverage also reflect shifting risk assessments. For example, some insurers might exclude certain types of damage commonly seen in recent disaster patterns or cap payouts more tightly. These shifts highlight the importance of closely reading policy terms after renewal periods and considering how personal risk tolerance aligns with coverage changes.

The Role of Reinsurance in Smoothing the Shock

Reinsurance is a crucial but less visible part of how premiums get adjusted after natural disasters. In essence, reinsurers provide insurance for insurers, helping to share the burden of unusually large claims. When disaster seasons produce catastrophic payouts, reinsurers may raise their prices or reduce coverage limits, which then trickles back into primary insurers raising premiums.

This chain reaction explains why premium impacts can be uneven and why some years bring significant increases while others remain relatively stable. The global reinsurance market’s conditions filter down into local premium structures, sometimes beyond what individual customers might expect based solely on regional damage assessments.

Living with the Consequences and Preparing Ahead

For consumers, understanding that premium increases following disaster seasons result from a blend of hard financial realities, regulatory oversight, and evolving risk models helps frame what might otherwise seem arbitrary. Several resources, such as the National Association of Insurance Commissioners, provide guidance on handling these adjustments and exploring options.

Moreover, taking an active role in mitigating risks-home improvements, disaster preparedness, or community resilience efforts-can influence how insurance companies view individual properties and possibly affect future premiums. Insurance is not only a financial product but part of a larger system responsive to both human action and nature’s unpredictable rhythms.

Ultimately, navigating the post-disaster insurance environment is a shared responsibility. Insurers confront mounting losses that prompt price changes to sustain solvency, and consumers weigh those costs against the security and peace of mind that insurance aims to deliver. Observing how these elements shift from season to season paints a clearer picture of the underlying mechanisms at play.

Sources and Helpful Links

- National Association of Insurance Commissioners – Natural Disasters and Insurance, comprehensive resource on disaster-related insurance issues

- Insurance Information Institute – How Natural Disasters Affect Insurance Rates, explains impact of catastrophes on insurance pricing

- State Department of Insurance, example regulatory body overseeing rates and consumer protection

- Insurance Reinsurance News, industry reports on reinsurance market trends affecting premiums