South Florida is a region marked by constant motion, not just in weather and culture but in the financial decisions its residents make. Among those choices, life insurance purchases quietly tell a story about deeper changes in the area’s economy and population makeup.

Where Growth and Risk Intersect

Life insurance is often viewed as a straightforward financial product, but in regions like South Florida, it unfolds layers of meaning about security and planning amid uncertainty. The area’s economic fabric feels the impact of both national trends and local quirks. Rising property costs, the influx of retirees with varying financial profiles, and shifts in job markets all form a backdrop against which people decide how much and what type of coverage to buy.

For instance, Miami and its surroundings have long attracted residents who command different levels of financial flexibility. Some arrive pursuing wealth preservation strategies, while others adjust their coverage to buffer risks associated with more volatile employment sectors like hospitality and construction. This reflects the broad economic spectrum in the region, where home values often climb faster than incomes.

The insurance industry data supports this complex picture. Areas seeing faster economic development often show upticks in life insurance policies, especially among younger families seeking stability. On the other hand, neighborhoods with larger retiree populations demonstrate different patterns, leaning more heavily toward final expense insurance or annuities linked to life coverage. These distinct preferences underscore how economic positioning shapes the perceived value and urgency of life insurance.

The Demographic Pulse Beneath Policy Sales

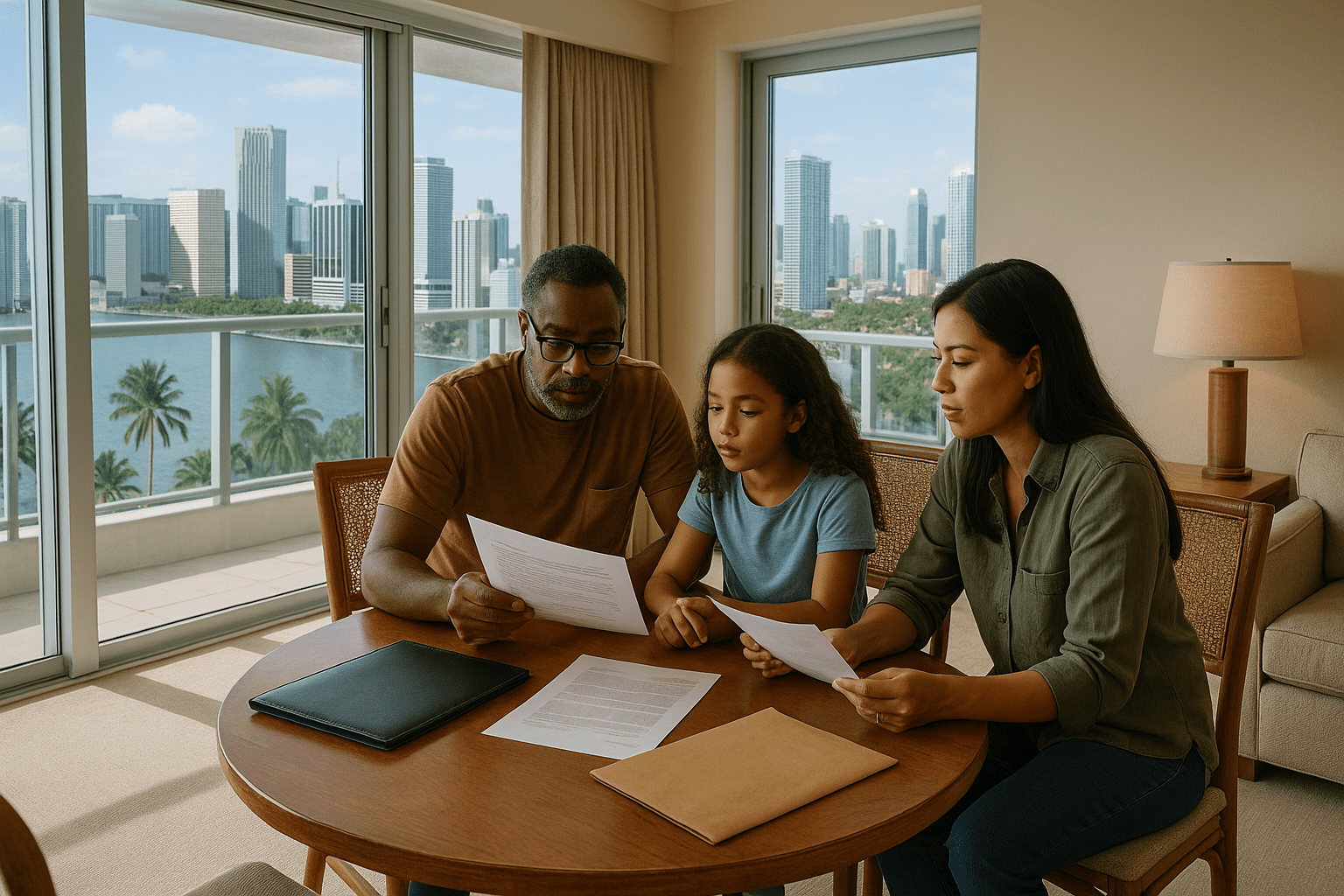

South Florida’s population is famously diverse in age, ethnicity, and socioeconomic status, which directly influences the life insurance market. The convergence of younger Hispanics, growing immigrant communities, and older White retirees creates a mosaic of insurance needs and buying behaviors.

Hispanic households, for example, often emphasize family protection and may prioritize term life insurance options that accommodate limited budgets but provide substantial temporary coverage. These choices echo cultural values around caretaking, but also respond to realities such as fluctuating employment or immigration status. Meanwhile, older White residents might gravitate toward whole life policies or hybrid products with investment components, reflecting longer time horizons and asset preservation goals.

Economic pressures also feed into this mix. Florida has witnessed large numbers of new residents relocating from pricier states seeking more affordable living. While they may bring more wealth and thus demand more complex life insurance solutions, those arriving in search of lower costs often operate under tighter financial constraints. The divergent paths of these groups play out in regional insurance data, showing spikes in both entry-level and premium policy purchases simultaneously.

Natural Disasters Add Another Layer

The South Florida region is no stranger to hurricanes and flooding, an environmental reality that influences financial priorities, including life insurance. Experiencing or even anticipating natural disasters highlights risks that stretch beyond homes and possessions to include personal health and family protection.

Insurance companies and advisors report that after major storms, there tends to be increased interest in coverage, not just for property but also for life and disability insurance. This pattern suggests an acute awareness of vulnerability among residents, especially those who have weathered losses personally. Understanding these cycles helps interpret changes in policy volumes, which fluctuate with the emotional and financial aftershocks of such events.

Though life insurance is not directly linked to property damage, the broader picture of risk management pushes many to consider all parts of their financial safety net. This includes preparing for the possibility that a disaster could alter a family’s income structure, even in ways that fall outside immediate claims for physical damage.

Access and Awareness Shape Decisions

It is worth noting that how life insurance sales grow or shift depends significantly on access to financial education and trusted advice. South Florida has a patchy landscape of resources, with robust financial literacy programs coexisting with pockets where understanding about insurance products remains limited.

Trusted local agents and community organizations often fill that gap, helping consumers navigate complex choices among term, whole, universal, and hybrid policies. Their guidance matters because the consequences of missteps can be severe, especially for families dealing with tight budgets or complicated health profiles. The degree to which education and trusted counsel reach residents shapes how policies evolve in different neighborhoods and demographic groups.

Additionally, digital tools and online platforms are increasingly present, enabling more convenient comparisons and faster purchase decisions. Yet, the digital divide still exists in places, so personal relationships remain crucial for many who prefer face-to-face explanations.

Broader Implications for the South Florida Community

Looking at life insurance purchases as a reflection of economic and demographic changes reveals how intertwined these elements are. Financial security plans respond not only to individual risk assessment but also to collective conditions-housing affordability, job stability, age distribution, cultural values, and hazards like hurricanes.

For the community, these patterns suggest areas where public and private sectors might focus support. Increasing financial literacy, ensuring equitable access to insurance options, and developing products tailored to diverse needs and evolving risks all emerge as ongoing priorities.

Ultimately, watching how South Floridians approach life insurance is like reading a localized economic barometer. It tracks shifting concerns, available resources, and adaptations to life’s uncertainties that define the region in a tangibly practical way.

Studies and detailed reports from sources such as the Florida Office of Insurance Regulation offer data that help contextualize these observations. National perspectives from the Life Happens organization provide additional layers to understand trends including policy types and consumer motivations. The intersection of such data with local conditions tells a richer story than numbers alone could reveal.

While the life insurance market may not capture headlines like housing or tourism, its nuanced shifts hold clues about how South Florida residents perceive and manage financial risk across changing decades.

Unfolding With the Region’s Story

Life insurance purchasing patterns do not stand apart from broader social and economic currents. They evolve gently as populations age, economies turn, and community priorities shift. South Florida’s trajectory is unique yet familiar-marked by growth, diversity, challenges, and resilience. Watching how residents protect their futures through life insurance offers insight not just into financial products, but into the lived experience of a region adapting fluidly to its own complex reality.

Sources and Helpful Links