It never feels quite simple to sign up for healthcare insurance. Every year, shifts in the enrollment window or renewal rules can cause a ripple effect in personal finances. Some changes are deliberate policy moves, others come as a natural reaction from consumers figuring out how best to manage their expenses and coverage needs. The dance between when, how, and whether people enroll in health insurance quietly reshapes risks they carry and costs they incur.

Enrollment Windows and Their Subtle Financial Pushes

The concept of fixed enrollment periods is meant to bring order, but it often creates tight timelines for decisions that matter hugely over the coming year. People who miss these windows, whether due to procrastination, confusion, or convenience, face gaps in coverage or higher barriers to jump back in. Financially, that could mean uncovered medical bills or having to pay full price for necessities.

This behavior underlines a striking reality about health insurance: it is a service that requires foresight and consistency, yet many people’s lives do not lend themselves well to careful long term planning. Job changes, income swings, or changes in family size can suddenly alter what kind of coverage is affordable or even reachable. These fluctuations interact with enrollment rules to influence who signs up, when, and for what.

Some recent data from the Kaiser Family Foundation suggests that a notable segment of uninsured Americans qualify for marketplace plans but still delay enrollment until faced with a medical event or penalty. This approach can lead to financial strain, as costs spike unexpectedly. The connection between enrollment timing and out of pocket spending is complicated but persistent.

Why Some Choose To Skip or Drop Coverage

One aspect that rarely gets the spotlight is the choice to voluntarily remain uninsured or to let coverage lapse. From a purely financial perspective, this might look like saving money in the short term by avoiding premiums. Yet this behavior often increases vulnerability to unexpected medical expenses. For some, it’s a gamble tied to uncertainty about usage or perceived health. For others, the calculations involve weighing premiums against other pressing costs like housing or childcare.

Health insurance is rarely a straightforward transaction; it carries anticipatory risk management with payoffs that are sometimes invisible until healthcare is suddenly needed. Dropping coverage might reduce monthly outlay, but it also exposes someone to potentially crushing debt if a serious health issue arises. This tension between immediate financial relief and future risk is a lived reality for many.

Interestingly, this dynamic also plays out around employment. Those whose jobs do not offer affordable insurance often fall into coverage gaps or patchwork solutions. According to the U.S. Census Bureau, employer-based insurance remains the largest source of coverage, which means employment patterns strongly influence enrollment behaviors.

Renewal Notices and Behavioral Economics

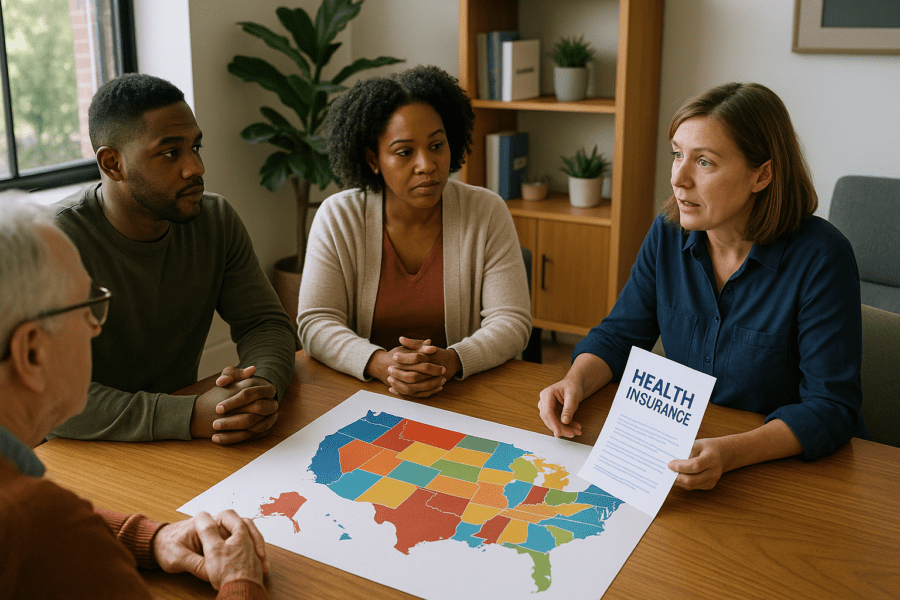

Renewal periods bring their own challenges. Although insurers and marketplaces send renewal notices, research points to many recipients overlooking or misunderstanding their significance. Behavioral economics suggests the presence of inertia, the tendency to do nothing because of decision fatigue or ambiguity. When renewal forms arrive laden with complex jargon or multiple plan options, people sometimes stick with a default, even if that choice is no longer financially optimal.

Switching plans can be daunting not only because of the paperwork but because people worry about losing trusted providers or facing new deductibles and copays. That fear keeps many locked into plans that might no longer fit changing budgets or health needs. These small behavioral tendencies wield outsized influence over individual finances across a population.

Moreover, changing federal and state policies on insurance subsidies, Medicaid expansions, or mandate penalties have complicated the calculus. The shifting landscape forces consumers to constantly re-evaluate their options without always having clear information on the financial impacts. This environment breeds uncertainty, and uncertainty fuels cautious or sometimes counterproductive enrollment behaviors.

Coverage Gaps and Their Ripple Effects

When people miss or skip enrollment opportunities, the gaps in coverage can create a cascade of financial consequences. For example, emergency room visits without insurance often translate into unpaid bills that linger and damage credit scores. Chronic condition management becomes erratic without steady insurance, leading to worse health outcomes and higher costs down the line.

Families juggling these coverage disruptions face particularly acute problems. A child needing ongoing care with inconsistent coverage triggers multiple reauthorizations, payments, or outright denials depending on timing. This unpredictability strains household budgets and complicates financial planning. It also highlights a fundamental tension: health insurance is supposed to smooth costs over time, yet enrollment disruptions often lead to cost spikes exactly when families least expect them.

Community health clinics and safety net programs often serve as a last resort for those caught between enrollment cycles, but their capacity is limited. The very act of navigating coverage gaps consumes time, energy, and resources that families cannot replenish easily.

Awareness of these ripple effects is growing among policymakers and consumer advocates, who are exploring ways to simplify enrollment, extend coverage periods, or provide better guidance through the renewal maze.

Technology platforms also play a growing role in smoothing enrollment processes. Apps and navigator programs attempt to make information clearer and deadlines more visible. Yet digital divides and distrust in technology create barriers, particularly in lower income or rural communities where enrollment changes can have outsized financial impact.

Ultimately, the changing landscape of healthcare insurance enrollment underlines a stark truth: financial stability over the course of a year depends heavily on timing decisions, access to clear information, and the ability to anticipate healthcare needs. The system requires involvement and foresight, which not everyone can afford to give.

As enrollment behaviors evolve, so too will patterns of financial risk and resilience. What remains constant is the high cost of uncertainty for individuals juggling health and money in an ever shifting system.

Sources and Helpful Links