The surge in remote work practices over recent years has quietly nudged businesses to rethink more than just where their employees set up laptops. It has also prompted a reconsideration of insurance policies crafted with in-office norms in mind. Assembling a workspace at home or another location brings distinct risks and liability considerations that often do not align neatly with traditional commercial insurance frameworks.

Noticing the Shifts Beneath the Surface

Many businesses discovered that the sudden migration of teams outside centralized office buildings challenged the assumptions embedded in their insurance contracts. For instance, property insurance for office premises may not automatically extend to cover equipment stationed at an employee27s residence. Concepts of theft, damage, and liability expand beyond familiar parameters.

There is also the question of workers’ compensation coverage. When employees operate remotely, the lines of responsibility blur between employer and employee, especially if injuries occur away from a designated workplace. Some policies required updates to clarify coverage for incidents happening in a home environment, where potential hazards are less standardized and more varied than in traditional offices.

Beyond the physical space, cybersecurity concerns have pushed companies to reassess their policies for data breaches and technology errors. Remote setups come with diverse network security challenges, increasing exposure to cyber risks. These challenges often prompt businesses to explore extending or upgrading their cyber liability insurance, a field that is rapidly evolving to accommodate threats unique to distributed workforces. Sources such as the Insurance Information Institute explain how digital vulnerabilities now play an outsized role in risk assessments.

Rethinking Liability in a Fragmented Workspace

Liability insurance has also seen evolving interpretations. In a conventional office, liability risks tend to be concentrated and somewhat predictable20 slip and fall incidents, equipment malfunction, or third-party property damage in a single location. With remote work dispersing the workforce, liability might involve issues at multiple addresses across different jurisdictions. The diversity of home environments means insurers must account for a variety of setups from dedicated offices to shared or temporary spaces.

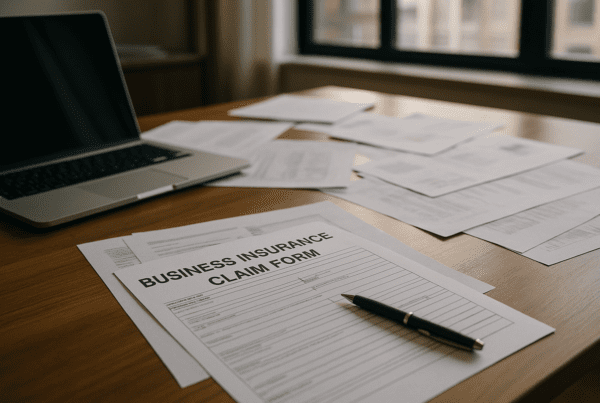

Insurance carriers are paying closer attention to coverage terms regarding remote site operations. Discussions with brokers and underwriters have become more common as businesses seek clarity on how exclusions, endorsements, or extensions apply to home offices. Some insurers have started to offer tailored endorsements addressing remote work scenarios, though these vary widely in scope and cost. The potential for coverage gaps has encouraged companies to be more proactive in communicating changes to insurers.

The challenge also intersects with compliance expectations. Various states and countries have distinct rules about employee safety, equipment standards, and data protection, complicating how liability is assessed and insured. Guidance from regulatory bodies, such as the Occupational Safety and Health Administration, reflects the shifting regulatory landscape that businesses must navigate when structuring their insurance and safety policies for remote workforces.

Adjusting Coverage and Premiums

For some companies, the decreased foot traffic to commercial properties translated into lower exposure to certain risks, sometimes softening premium pressures. However, this was often offset by additional coverage needs related to remote risks. The balance of risk has shifted rather than decreased overall, compelling insurers to adjust their models and pricing structures.

For example, businesses may have invested in comprehensive cyber liability coverage or augmented their property policies to better protect off-site assets. The increased blend of personal and business property raises questions about valuation and claims processes, requiring insurers to refine their risk assessment models. Brokers often report that claims resulting from home office setups require more nuanced investigation due to varied environments.

Brokerage reports indicate that many firms approached insurers proactively, seeking to avoid potential claim denials by informing carriers about operational changes. This communication is crucial since undisclosed material changes in business practices can affect claim outcomes and coverage validity. Transparency helps avoid surprises and supports smoother claims handling.

Embracing New Insurance Products and Services

Market responses to the remote work transformation have included innovative products designed to address emerging gaps. Some insurers package hybrid business insurance that accounts for both traditional premises and remote employee locations. These policies often come with targeted services, including risk assessments for home offices and consulting on best practices for maintaining security and safety outside a central workplace.

Technology providers also play a role by offering platforms that monitor risks in real time, facilitate claims remotely, or integrate cyber defense tools with insurance offerings. This integration reflects a broader trend toward digitalization in insurance, helping bridge the gap between coverage and operational realities.

For risk managers and business leaders, integrating insurance strategy with evolving operational models has become an ongoing discussion rather than a set-it-and-forget-it decision. With workplaces shifting fluidly between physical and virtual environments, insurance arrangements will likely require continual review and adaptation to remain relevant and effective.

Looking Beyond the Immediate

While the pandemic accelerated remote work adoption, the conversation around insurance shifts is far from transient. The underlying patterns suggest a more permanent hybrid model will persist for many organizations. This permanence cements the need for insurance frameworks that understand day-to-day realities of dispersed teams rather than legacy assumptions about offices as the primary locus of risk.

Moreover, insurance literacy among business owners and managers is becoming increasingly important. Understanding how policy language interacts with new work arrangements helps avoid unpleasant surprises and fosters partnerships with carriers oriented toward solving contemporary challenges. Resources such as Business Insurance cover emerging trends and broker perspectives that illuminate how the industry is evolving.

Ultimately, the expansion of remote work adds texture to the ongoing dialogue about risk management, coverage adequacy, and insurance product innovation. It also reinforces the notion that insurance, rather than a static contract, is an adaptive framework reflecting the shifting patterns of how work gets done.

Recognizing this dynamic can aid businesses in navigating insurance complexities with more confidence and realism, turning what could feel like a burden into an asset supporting resiliency and continuity.

Sources and Helpful Links