As the business world continues to unfold in complex and unpredictable ways, the quiet ledger of insurance claims has become a telling chronicle of change. Behind those numbers lie signals of how industries are adapting, struggling, and sometimes exposed in the face of new challenges. Claims data is not just a tally of losses but a narrative about evolving risks and the growing gaps that companies and insurers must bridge.

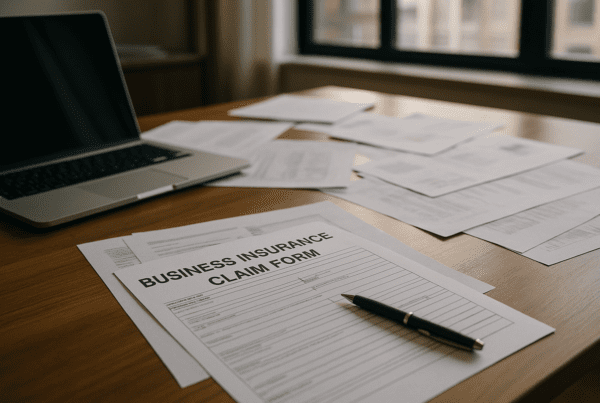

Claims Patterns Tell Stories Beyond Headlines

Insurance claims capture the consequences of real business events-accidents, breaches, interruptions-that can quickly escalate beyond individual incidents. When viewed collectively over time and across sectors, these filings reveal a tapestry of risk shifting beneath the surface.

Take supply chains, for instance. Increasing claims for shipment delays, contractual failures, or inventory losses don’t just reflect momentary glitches. They can mark deeper systemic issues such as geopolitical tensions, raw material shortages, or the ripple effects of pandemic disruptions. Similarly, manufacturing, retail, and service industries all show patterns of claims that echo broader economic strains or evolving consumer demands.

Meanwhile, cybersecurity claims have grown from occasional to a mainstay concern. The surge in digital threats-ransomware attacks, data breaches, and fraud-illustrates how business operations are entwined with IT vulnerabilities. Insurers face mounting difficulty predicting exposures, even as businesses scramble to protect both customer information and their own infrastructures.

When Coverage Encounters New Challenges

Insurance policies tend to reflect known risks at the time they are written. Emerging hazards introduce uncertainties that stress these frameworks. Claims data can highlight where coverage may fall short, where disputes arise over what qualifies as a loss, or where businesses face exposure due to regulatory or market shifts.

Environmental liabilities provide a clear example. Rising claims associated with pollution matters or carbon emissions stem not only from increasing environmental impact but from evolving laws and expectations. As governments tighten regulations and stakeholders demand more responsibility, companies often find their historic policies inadequate without customization. This pushes insurers to rethink terms and design new products that address a more dynamic risk environment, one where sustainability and compliance intertwine.

Economic and Social Currents Reflected in Claims

The contours of claims activity also capture how economic and social habits evolve in ways that affect risk exposure. Consider the rise of remote work. While it offers flexibility and cost savings for many companies, it has introduced fresh challenges for insurance. Claims tied to home office accidents, equipment damage, or decentralized cybersecurity vulnerabilities have emerged as significant categories. These risks can be subtle and diffuse, unlike traditional claims tied to physical workplaces or centralized IT systems.

Labor market dynamics also come into sharper focus through claims. Changes in workers compensation claims or increases in workplace injuries often reflect broader pressures such as labor shortages, workforce skills gaps, or intensified operational tempos. Such patterns emphasize how human factors remain a core part of risk, even as technologies and markets evolve.

Beyond the headlines and press releases, it is the granular and real-time data in claims filings that offer a fresh perspective on how businesses experience challenges and adapt practically to them.

Turning Claims Data Into Strategic Insight

Business leaders increasingly recognize that claims data is a practical compass for managing risk. Frequent or serious claims in a particular area can prompt changes in operations, supplier choices, safety protocols, or technology investments. This back-and-forth between experience and response grounds risk management in reality rather than theory.

Insurers, too, leverage this data to refine risk models and craft products better suited to shifting needs. For example, cyber insurance now often involves pre-breach risk assessments and resources dedicated to incident response, shaped directly by the kinds of claims encountered in recent years. Environmental insurance likewise is adapting, offering coverage solutions that factor in regulatory trajectories and sustainability goals.

This evolving dialogue between claims and strategy creates a more responsive insurance market and a more resilient business community. Claims data effectively becomes a form of market intelligence, bringing clarity to what might otherwise be unforeseen or underestimated risks.

Adapting to Change Remains an Ongoing Venture

The landscape that claims data maps out is one of constant flux. Risks once regarded as negligible can grow rapidly, shaped by technological progress and social change. At the same time, new innovations create vulnerabilities alongside opportunities, challenging businesses and insurers to stay vigilant.

Successful navigation of this environment depends on being alert to shifts that claims data can reveal early. Even small upticks in particular claim types may signal emerging challenges that merit attention before they become critical.

Watching these developments is no mere academic exercise. It matters because managing risk effectively can influence everything from a company’s financial health to its reputation and long-term viability.

Ultimately, business insurance claims tell a story both about what happens when things go wrong and how companies learn and evolve in response. They offer a ground-level view of risks as they play out-not in abstract terms but in the textures of daily commercial life.

For those tracking these developments and seeking detailed, reliable data on claims trends, organizations like the National Association of Insurance Commissioners provide extensive reporting and regulatory context. The Insurance Information Institute also offers accessible educational resources that help explain how claims data shapes insurance markets. Industry-focused reports like those from Ivans Insurance Report shed light on technological changes and claims patterns affecting insurers and businesses alike.

The patterns emerging from business insurance claims hold real clues about risk, resilience, and opportunity across the commercial landscape. Observing and interpreting those patterns is an essential part of understanding the financial and operational realities companies must face as the world continues to change.

Sources and Helpful Links

- National Association of Insurance Commissioners, regulatory insights and insurance market data

- Insurance Information Institute, educational resources on insurance topics

- Ivans Insurance Report, industry reports on insurance technology and claims trends