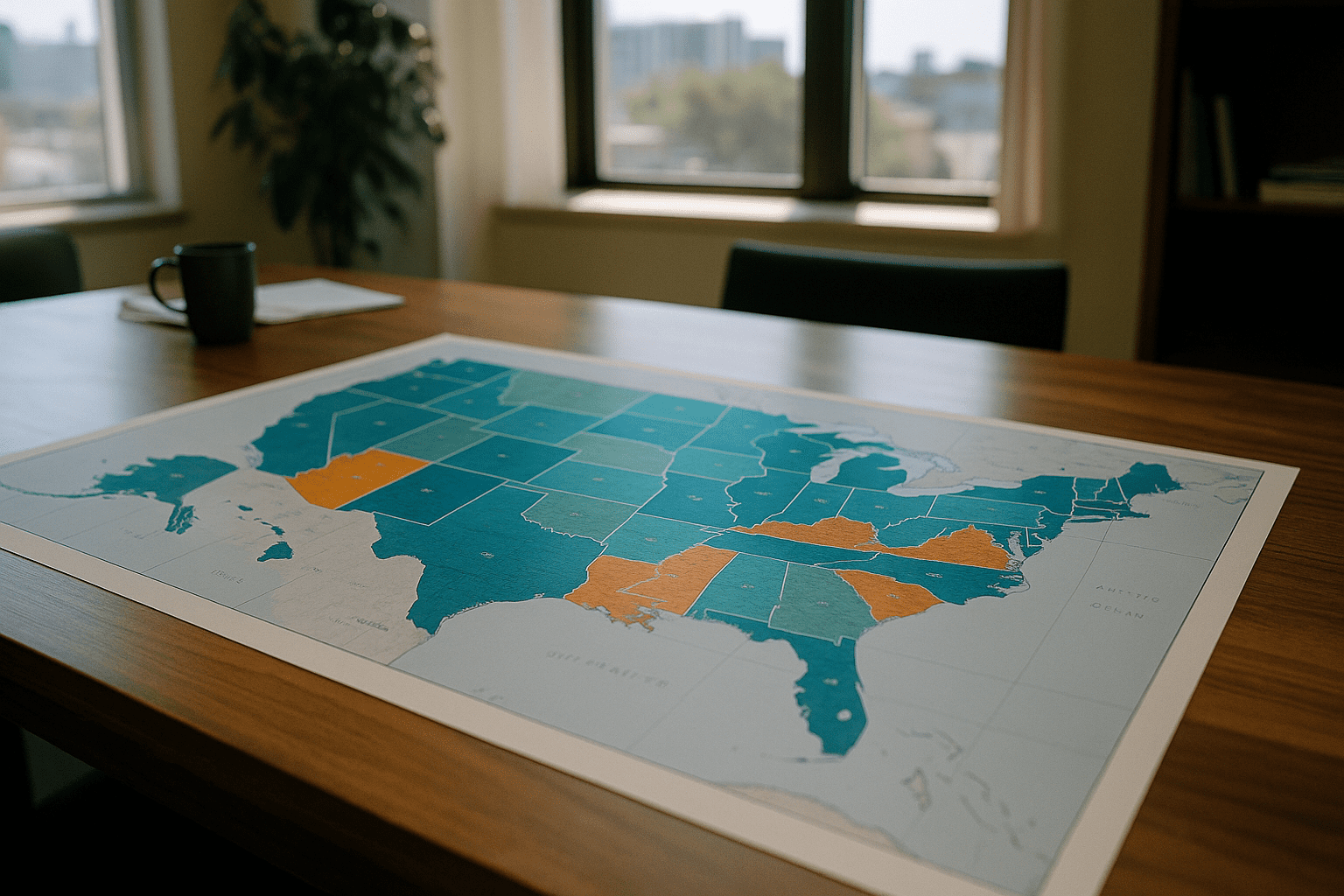

Not all health insurance coverage is created equal across the United States. Instead, where someone lives plays an outsized role in whether and how they are covered by health insurance. These geographic differences have deep roots in economics, government policy, demographics, and the patchwork nature of the US health system.

The geography of coverage stretches beyond city lines

At first glance, the division between having insurance or going uninsured might appear like a simple, clear-cut matter. But as you zoom in on the map, the picture becomes more complex. Urban centers in the Northeast and West Coast often show higher enrollment rates, which correspond with expansive state healthcare programs and more competitive insurance markets.

Contrast that with many rural areas in the South and Midwest, where enrollment rates lag. Factors such as fewer employers offering insurance, limited outreach programs, and more residents eligible for public programs who remain unenrolled all cooperate to deepen coverage gaps.

These variation patterns were notably highlighted by the Centers for Disease Control and Prevention in their release of insurance coverage statistics, showing that, for example, states like Massachusetts and Vermont boast uninsured rates under 5 percent while others, including Texas and Florida, hover closer to 15 percent or more according to CDC data.

Public programs mold local enrollment landscapes

Medicaid expansion under the Affordable Care Act is a major driver behind some of the regional differences in coverage. States that adopted expansion generally see lower uninsured rates. This makes intuitive sense since Medicaid offers a more affordable option for lower-income residents to get coverage. But those decisions are state-level choices and have not been universally embraced.

This uneven adoption means some areas struggle with coverage holes where many residents fall into a “coverage gap” under Medicaid income thresholds but cannot afford private insurance. The Kaiser Family Foundation notes that this gap persists most sharply in southern states that declined Medicaid expansion, complicating coverage access for millions as reported by Kaiser Family Foundation.

Economic opportunity and the employer market intertwine

The employment landscape reflects regional disparities as well. In areas with manufacturing, technology, or large corporate presences, insurance offered through employers is often the main avenue to coverage. Outside of these pockets, particularly in regions experiencing economic hardship or declines in traditional industries, fewer employers offer comprehensive benefits.

Small business prevalence without access to group plans and higher rates of gig or contract work also influence enrollment rates. According to data from the US Census Bureau, states with larger gig economies tend to have more uninsured residents because this work generally lacks employer-based coverage opportunities noted by the Census.

Demographics and cultural factors shape decisions

Population demographics and cultural attitudes towards insurance also feed the enrollment patterns. Younger populations, often clustered in urban or college-town regions, may choose to remain uninsured more frequently due to perceived low risk or cost concerns. Conversely, areas with older populations might show higher enrollment due to increased healthcare needs.

Language barriers, immigration status, and trust in government programs further explain regional discrepancies. In some communities, even when coverage is available, reaching and enrolling residents presents significant challenges for outreach programs.

A patchwork future in a patchwork system

US health insurance enrollment is unlikely to converge into a uniform pattern soon. The interplay of state policies, local economic conditions, population types, and healthcare infrastructure keeps the picture varied. Each region carries its own story about coverage shaped by decades of development, political decisions, and economic shifts.

For individuals and policymakers alike, appreciating these geographic nuances offers a clearer lens on why millions remain without coverage and why solutions must consider local realities as much as national goals. Recognizing that geography remains both a map and a mirror of coverage helps us understand health insurance enrollment as a lived experience, not just a policy statistic.

As coverage data evolves, resources like state health department reports, national surveys by the CDC or Census, and analyses by nonprofit health research organizations provide ongoing insight into how this vital aspect of financial security weaves through American geography.

Understanding the overlapping factors that mold health insurance enrollment is crucial for those navigating the system and for anyone curious about what coverage really looks like beyond the headlines.

Those seeking to explore further might consider how enrollment patterns intersect with healthcare access, affordability, and outcomes in their own communities and beyond.

Not every map shows the whole story

Even with extensive data, some nuances evade simple capture. Enrollment numbers can mask differences in coverage quality, plan networks, and out-of-pocket cost burdens. Regional insurance markets also respond to changes in federal regulation, market consolidations, and new technology that may shift enrollment patterns over time.

Yet the geography of enrollment matters deeply as a marker of where people stand in relation to healthcare security. Recognizing these regional disparities shines a light on both barriers and opportunities that mark the ongoing story of health insurance in the US.

For anyone following health policy or simply paying attention to the availability of health insurance in their area, noticing how enrollment shifts by place can broaden perspective on what coverage means and what challenges remain.

These patterns invite ongoing attention, as coverage is not just a number but a patchwork of lived realities across neighborhoods, cities, and states. The map changes slowly, reflecting politics, economics, and social changes that shape the ground on which healthcare is delivered.

And so, while data points and reports provide the foundation, it is the understanding of place that gives meaning and context to health insurance enrollment across the nation.

Sources and Helpful Links

- CDC Health Insurance Coverage Data, latest insurance coverage statistics by geography and demographics

- Kaiser Family Foundation on Medicaid Expansion, overview of state decisions and impacts on coverage

- US Census Gig Economy Data, labor force details linked to insurance access