Looking closely at homeowners insurance claims reveals something less obvious than the financial impact of damage or loss. These claims tend to mirror long-term changes in how homeowners maintain their properties and respond to emerging risks. Patterns in claims data offer a window into the habits, priorities, and sometimes challenges that shape real estate upkeep across different regions and income groups.

When Claims Tell More Than Themselves

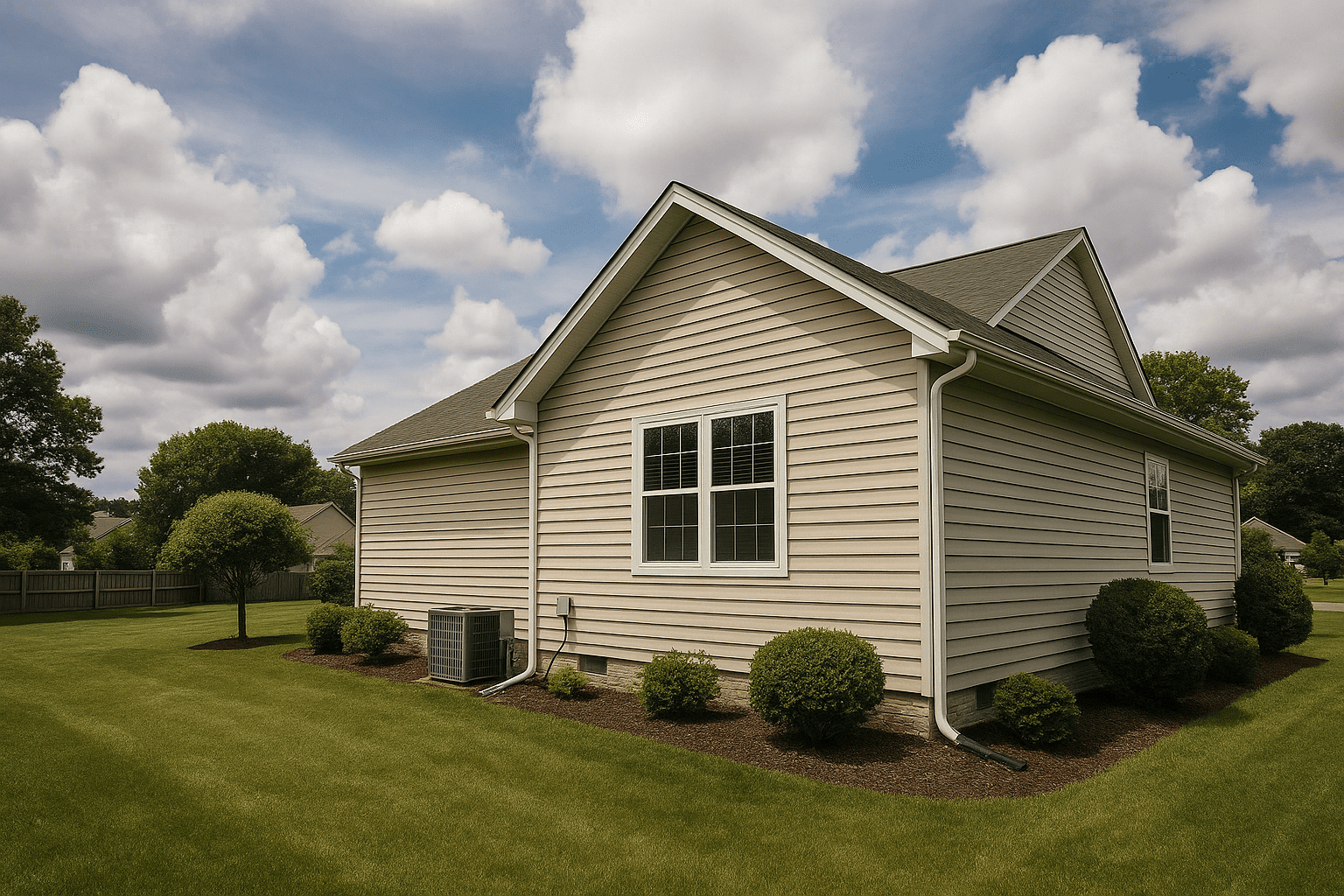

Claims naturally arise from accidents or failures: a tree limb falling on a roof, water seeping in through aging siding, or a burst pipe in winter. But the frequency and nature of these claims also reflect the underlying state of property maintenance, which shifts slowly alongside lifestyle, economic conditions, and awareness of risk.

For example, many insurers have noted rising claims related to water damage. Behind the numbers, this trend often speaks to aging infrastructure within homes and sometimes to postponed maintenance. Property owners might delay repairing gutters, replacing old pipes, or addressing foundation issues due to cost, time, or competing priorities. The resulting damage, when finally noticed, is often extensive enough to trigger a claims visit.

At the same time, shifting weather patterns have added complexity to property upkeep. More frequent or intense storms mean that preventive measures that once seemed adequate might no longer be enough. Certain areas see increased wind damage, while others report more flooding and water intrusion problems. These environmental changes encourage some homeowners to reassess how they maintain their properties, but others may not yet feel the urgency or may lack the resources.

Maintenance Habits and Regional Differences

Geography plays a critical role. In dry climates, for instance, wildfire risks have pushed both homeowners and insurers to pay closer attention to defensible space, brush clearance, and roofing materials resistant to embers. Claims related to fire damage may thus reflect whether such maintenance steps were followed or overlooked.

Conversely, in colder regions, freeze-related plumbing failures reveal how well properties withstand harsher seasons. An uptick in pipe bursts could suggest older homes or newer construction that did not fully anticipate extreme cold spells. It also points to homeowner vigilance in tasks such as drainage management and insulation. Sometimes, newer developments have undersized pipes or inadequate insulation that show their limits under stress, affecting claim patterns.

Urban versus rural divides introduce another layer. Urban properties may see more claims from vandalism or accidental damage, while rural homes deal with natural risks like falling trees or animal intrusions. Homeowners across these settings develop different routines and preventive actions, gradually reflected in insurance claim trends. Some rural areas may face greater difficulties accessing contractors quickly, increasing the chance that small issues escalate before repair.

Income and Investment in Home Care

Financial resources directly influence maintenance decisions. Homeowners with greater means often invest proactively in upkeep, guided by both personal priorities and advice from property managers or insurers. This can suppress some types of claims by addressing issues before loss occurs. For those with tighter budgets, however, important repairs may be deferred, unintentionally increasing the chance of insurance claims later.

Insurance companies sometimes adjust their pricing or coverage options based on observed maintenance patterns or claims history within certain demographics. This feedback loop can incentivize property owners to improve care routines but also occasionally creates affordability challenges, especially if premiums rise sharply due to concentrated claims in an area.

In neighborhoods where older housing stock is common, the cost of ongoing maintenance often competes with other household expenses. Deferred upkeep can lead to a buildup of small issues that complicate claims when damage occurs. This tends to cause a cycle where claims go up because of neglect, and insurance costs also rise because of the increased risk.

The Subtle Influence of Technology on Maintenance and Claims

Modern technology is quietly shifting how people approach home maintenance and risk management. Smart home devices, moisture sensors, and remotely monitored security systems can alert homeowners to potential problems before they escalate. While still not universally adopted, these tools begin to change the timing and type of claims filed.

For instance, a water leak detected early through a sensor may prevent extensive damage and negate the need for an insurance claim. On the other hand, increased awareness of minor issues might encourage more claims for things that would previously have been unnoticed or tolerated without immediate repair.

Insurance providers are increasingly integrating data from these technologies into underwriting and claims processes. This innovation promises a more dynamic understanding of property risks and maintenance behaviors over time. Some insurers offer discounts or incentives for homes equipped with monitoring devices, which shows how technology influences maintenance habits indirectly.

Even as technology advances, though, adoption often skews toward homeowners with more resources or technical comfort, which may deepen disparities in claim trends tied to income or region.

Reading Claims as a Mirror for Homeowner Behavior

Claims data, when viewed through a wider lens, do more than quantify losses. They reveal how residents manage or neglect the ongoing responsibility of home care. Small details such as windows left unrepaired, roofing shingles ignored, or cluttered yards might correlate with claims experiences in ways that turn statistics into stories about everyday lives.

Insurance remains a safety net for accidents and unexpected damage, but it also signals where preventive care might be slipping. Watching changes in claim patterns can help insurers, regulators, and homeowners themselves to identify evolving challenges and opportunities for better maintenance strategies.

For example, a rise in claims caused by mold or water intrusion can inform community outreach programs about the need for education on gutter maintenance or foundation inspections. Similarly, clustered fire claims in areas prone to wildfires might push local authorities or insurers to promote more rigorous vegetation management.

In the end, a claim is a reflection of more than just an event. It marks a moment where the usual relationship between property, environment, and human care is tested, sometimes revealing an underlying shift in how homes are maintained. Recognizing these patterns invites a broader conversation about the practical challenges of property upkeep in a changing world.

Sources and Helpful Links