The world of credit reporting often feels like an opaque system, driven by numbers and formulas that seem distant from everyday financial lives. Yet when there are shifts in how credit information is gathered and reported, the effects ripple outward. Borrowers might notice subtle differences in their scores or loan eligibility without a clear explanation. Behind these quiet changes lies a set of evolving policies and practices that aim to make credit evaluations more accurate, fair, or nuanced. But the results are far from uniform.

More Data, But What Does It Really Mean?

In recent years, credit bureaus have explored including new types of data fields in consumer reports. Some additions involve rent payments, utility bills, or even subscription services that were traditionally invisible to lenders. The intention is straightforward: by broadening the scope of credit data, more consumers, especially those with limited credit history, could be better represented and potentially improve their borrowing power.

However, the experience is mixed. Including rental payments, for example, can help consumers build a positive track record if those payments are made on time. Yet, administrative inconsistencies or missing data can create gaps or inaccuracies. Not every lender or landlord reports payment history to credit bureaus, so the reported picture is often incomplete. Furthermore, some scores weigh this alternative data differently.

This shift toward using alternative data points reflects a broader recalibration of what financial trustworthiness means in modern credit assessment. It acknowledges that traditional markers, such as credit cards or loans, do not cover everyone fairly. Yet it also introduces new challenges in ensuring that information is accurate, timely, and treated in context.

Score Updates and Consumer Confusion

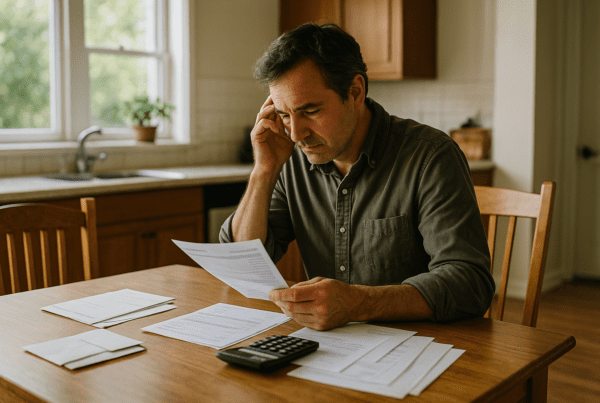

When credit reporting systems update their models or the inputs they accept, consumer credit scores sometimes adjust in unexpected ways. A person who once enjoyed a stable score could see changes they do not fully understand or anticipate. This can be unsettling, especially when those scores determine the cost of borrowing or even eligibility.

One observation from recent changes is that tracking credit behavior through emerging data sources has created more variation in scoring outcomes. For some consumers, this can be an opportunity to demonstrate creditworthiness in new light. For others, especially those with inconsistent payment histories or thin files, it may result in unintended score fluctuations.

Complicating matters, different scoring models might react distinctly to these new data sets. A credit score provided by one bureau or for a particular lender might show improvement, while another might reflect no change or a decline. This inconsistency highlights a fundamental complexity in credit scoring: there is no single universal score that governs all lending decisions.

Regulations and Reporting Practices Still Evolving

Credit reporting in the United States is governed by the Fair Credit Reporting Act and overseen by the Consumer Financial Protection Bureau (CFPB). Over time, these regulations have adapted to reflect consumer protection priorities and technological advances. Yet the process of incorporating new types of data into credit reports requires careful balancing to protect consumer rights and ensure accuracy.

Recent guidance from the CFPB encourages reasonable inclusion of alternative data but underscores transparency and accuracy. Agencies must validate the sources and ensure consumers can dispute errors effectively. As these reporting practices evolve, lenders and borrowers alike negotiate a shifting landscape with unclear boundaries.

Another dimension arises from how quickly credit bureaus update or remove items based on new policies. For instance, temporary relief measures during economic disruptions can lead to delayed reporting of missed payments. When those policies expire, rapid score shifts may occur, adding to consumer uncertainty about their financial standing.

What Consumers Can Observe and Question

Despite the technical adjustments underway, the core dynamic remains: credit reporting and scoring aim to summarize a complex financial reputation through a number. Borrowers might find it worthwhile to examine how their credit profile has transformed with new reporting changes.

Many consumers are not fully aware that alternative data such as rent or utility payments could appear on their reports. Obtaining personalized credit reports from major bureaus regularly becomes essential. It allows consumers to spot unexpected information, errors, or gaps that could influence their borrowing power.

Additionally, consumers may see value in how various lenders pull and interpret credit data. Understanding that not every credit check uses the same models or data sets can provide more realistic expectations. If scores differ widely, it might reflect models prioritizing different elements of financial behavior rather than a straightforward good-bad metric.

Patience and vigilance become useful responses to these quiet but impactful changes in credit reporting. Consumers who stay informed and seek clarity where possible will navigate borrowing decisions with greater confidence. Financial trust is never just about a score; it is about understanding the rules of the game as they shift beneath our feet.

As these reporting trends continue to unfold, they highlight the tension inherent in any system attempting to translate individual money management into a single number. The journey from raw data to borrowing power remains a real world puzzle, shaped by regulation, technology, and countless small financial choices over time.

Sources and Helpful Links

- Consumer Financial Protection Bureau Credit Reports and Scores, guidance on credit reporting and consumer rights

- Experian on Alternative Data in Credit Reports, explanation of rent and utility payments inclusion

- Federal Trade Commission Business Guidance on Credit Reporting, legal compliance and reporting practices for businesses

- FICO Credit Score Variations Explained, insight into different scoring models and their effects