More than just a collection of numbers for insurers, recent auto insurance data reveals a nuanced picture of how people’s driving habits are evolving. This data encompasses miles driven, accident and claim frequencies, rates of distracted driving, and other factors that point to broader shifts. These changes unfold in tandem with transformations in lifestyles, work arrangements, technology features in vehicles, and attitudes about safety and risk on the road.

When Miles Tell a Story Beyond the Odometer

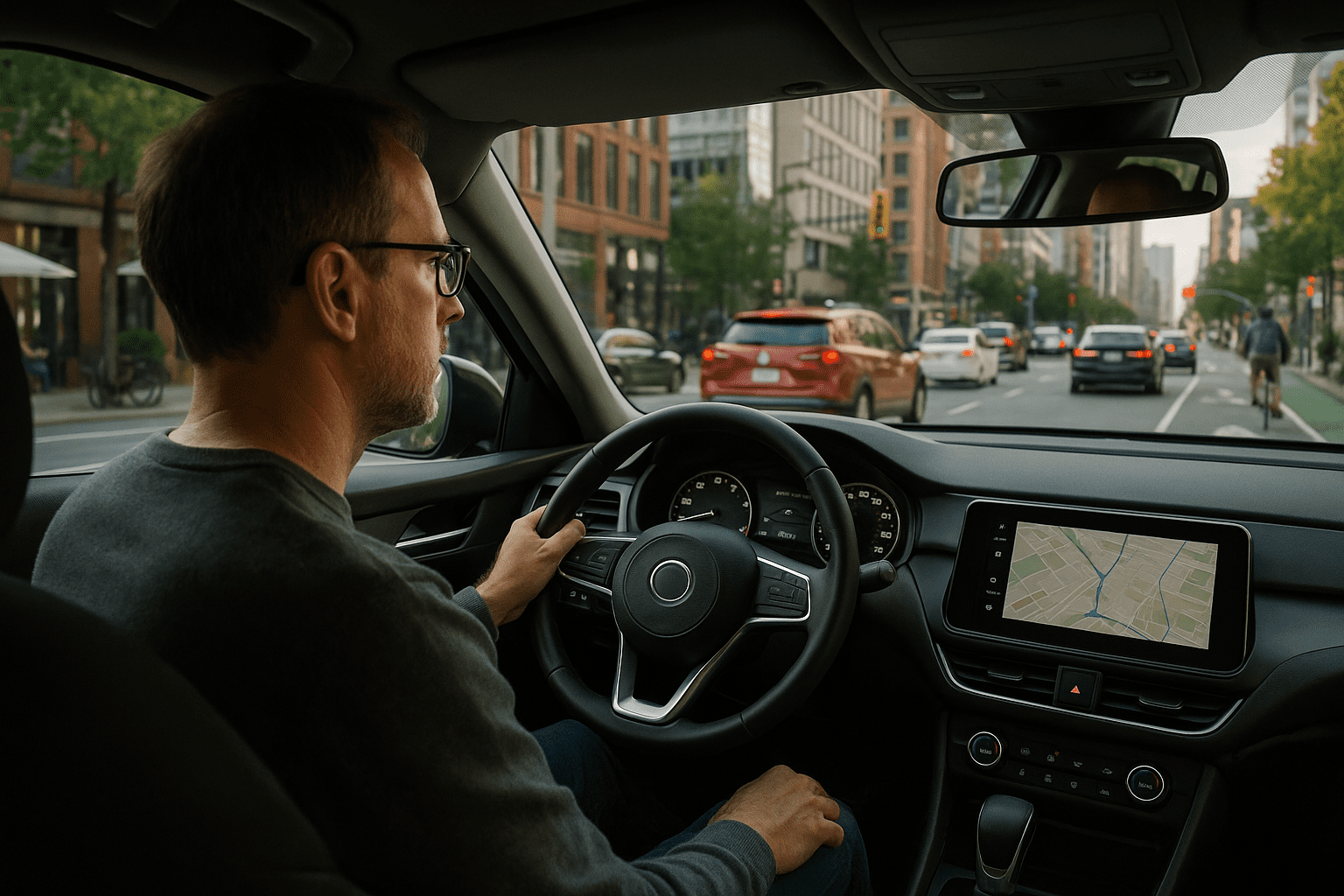

How much people drive remains a foundational component of auto insurance risk assessment. A closer look at recent data reveals a lasting trend toward lower annual mileage for many drivers compared to years past. The pandemic accelerated remote work and reduced commuting, but even as some routines have resumed, driving frequency has not fully bounced back.

This decline does more than just affect premiums. It speaks to a reshaped relationship with automobiles. For some, driving is no longer a daily necessity but a carefully weighed choice. Urban residents increasingly combine public transportation, biking, walking, or ridesharing with limited car use. Meanwhile, those in suburban or rural settings continue to depend heavily on personal vehicles but may also adjust travel habits due to cost or convenience.

There remains considerable variation across demographics. Younger drivers, for instance, may be venturing out more for social activities after previous restrictions. Older drivers might pull back on trips overall, reflecting health and mobility considerations. Organizations like the Insurance Information Institute periodically highlight these variations as contributing forces behind shifting auto insurance landscapes.

Claims Patterns Draw a Complex Risk Map

Looking beyond mileage, claims data reveals subtler changes in exposure to risk that reflect both old and new patterns. Many insurers report fewer minor collision claims, which aligns with sustained reductions in traffic congestion during remote work phases. Yet other categories, such as single-vehicle crashes or damage to parked cars, show less predictable swings. These may relate to alterations in parking habits, driver attention, or even neighborhood dynamics.

Distracted driving continues to be a significant factor in claims, stubbornly persistent despite decreased driving in some groups. Activities like texting, eating, or adjusting audio devices remain common risks, a reality underscored by data from agencies such as the National Highway Traffic Safety Administration. The multifaceted nature of distracted driving means it does not neatly correlate with miles driven or general risk profiles.

Geographic differences add another layer. Certain regions face higher claims driven by aggressive driving styles or environmental factors like road conditions and weather. These distinctions show how local culture and enforcement influence not only driver behavior but also insurance outcomes, painting a picture that resists simple generalizations.

The Role of Telematics and Vehicle Technology

Modern telematics programs offer a window into real driving behavior at an unprecedented level of detail. By capturing data on speed, acceleration, braking, and even timing of trips, these technologies help insurers move beyond traditional risk proxies. Customers who opt into these programs can receive more accurate pricing based on their actual driving habits.

There is evidence that knowing one is being monitored can encourage safer driving, at least temporarily. The behavior shift is not uniform, as participation is voluntary and individual motivation varies. Yet these programs represent a growing trend in insurance toward personalized risk assessment, a development influenced by the availability of connected vehicle data.

Simultaneously, the vehicles themselves have become technology platforms that influence how people drive and what risks they face. Features like automatic emergency braking, lane keeping assistance, blind spot warnings, and collision alerts are becoming standard. Research from the Insurance Institute for Highway Safety suggests these systems are effective at lowering crash rates and mitigating severity, although the full insurance impact is still emerging over time.

Changing Social Contexts Shape How Cars Fit Into Daily Life

Driving no longer means the same thing for everyone. Social, economic, and environmental changes all figure into how cars are used. Urban dwellers might see their car as one option among many, while those in less dense areas often rely on personal vehicles as a necessity.

Generational shifts are notable too. Many younger people delay acquiring a driver’s license or opt out of car ownership in favor of alternatives like biking, scooters, or public transit. These choices reflect broader concerns around cost, sustainability, and the convenience of emerging mobility options. At the same time, some groups turn instead to driving more, particularly when public transportation systems fall short or carry perceived risks, a pattern highlighted during recent public health events.

Weaving through these trends is a complex mix of influences, from economic factors to cultural attitudes about freedom and responsibility. Auto insurance data, when observed alongside these contexts, reveals a patchwork of local and individual decisions rather than uniform shifts. This complexity reminds us that behind every aggregate statistic are very personal stories of how people negotiate mobility in a changing world.

The evolving patterns in the data invite ongoing attention. They reflect a balance between risk, cost, convenience, and values, all filtered through a technology-enhanced lens. Rather than a linear narrative, these shifts form a multifaceted view of modern driving, grounded in the realities of everyday life and the tools people use to navigate it.

Sources and Helpful Links

- Insurance Information Institute, comprehensive auto insurance statistics and trends

- National Highway Traffic Safety Administration, detailed data on distracted driving and safety

- Insurance Institute for Highway Safety, research on technology in vehicles and crash outcomes