Credit scores have quietly ruled consumers’ access to borrowing for decades. They serve as gatekeepers, deciding who can secure loans, mortgages, or credit cards, and at what cost. But credit scoring itself is not set in stone; it has grown more complex over the years. Newer models are emerging that take into account a wider array of financial behaviors, reshaping who appears creditworthy and what borrowing capacity they might enjoy.

More Than Just A Number

Most people are familiar with the traditional credit scores developed by major credit reporting agencies like FICO and VantageScore. These scores rely heavily on payment history, amounts owed, length of credit history, types of credit, and recent credit inquiries. While these factors have served as a rough summary of financial reliability, they miss a fuller picture of someone’s financial life.

Innovations in credit scoring now draw on alternative data sources to capture nuances traditional models have overlooked. These can include timely rent payments, utility bills, subscription services, and sometimes even checking account transactions. For many consumers with limited or no traditional credit history-so-called thin file borrowers-these bits of information can enhance access to credit.

This expansion is part of ongoing efforts by agencies and lenders to reach broader populations with a more refined measure of credit risk. The approach, often called alternative or expanded credit scoring, aims to make lending decisions fairer and more inclusive.

The Subtle Shift in Borrowing Capacity

When new data factors into credit scores, the effects on borrowing capacity can be significant, though often subtle and varied. For example, someone who has consistently paid rent and utilities on time but has only one or two credit accounts might see their creditworthiness rise under a model that recognizes these payments. That can translate into higher credit limits, lower interest rates, or loan approvals where traditional models might have declined.

However, adoption of these new credit scoring models among lenders is uneven. Some banks and credit card issuers are cautious about using alternative data due to concerns about regulatory oversight and the accuracy of new inputs. Meanwhile, fintech firms and smaller lenders tend to experiment more aggressively with these models, trying to capture underserved borrowers.

The borrowing capacity influenced by these assessments does not always operate as a simple upgrade for consumers. Broader inclusion can also mean more competition among borrowers for credit offerings, which could affect terms indirectly. And new scoring methods can sometimes penalize borrowers whose alternative data does not align neatly with creditworthiness due to irregular financial behaviors.

The Ripples Beyond Individual Borrowers

These changes in credit scoring models also ripple through the credit markets broadly. As lender risk calculations shift, institutions might adjust strategies around credit limits, product offerings, and interest rates. This flow-on effect impacts how capital moves through the economy and who gains access to it.

For investors and policymakers, the evolving credit score landscape requires careful monitoring. Expanded models may bring more people into the credit system, which could be beneficial for economic participation and growth. At the same time, new risks emerge if data inputs are less reliable or if models unintentionally reinforce inequalities because of the kinds of alternative data included.

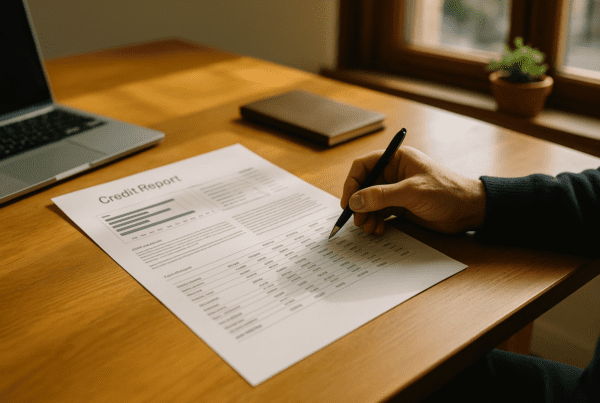

Consumer advocates emphasize transparency. It is crucial that borrowers understand how their credit scores are calculated and what factors drive decisions that affect their borrowing. Resources like the Consumer Financial Protection Bureau’s explanation on credit scores help illuminate some of this complexity.

A Changing Landscape Worth Watching

The gradual rise of new credit scoring models can feel like a background change to many consumers. Yet the implications touch fundamental aspects of financial life, including access to mortgages, student loans, and credit cards. They influence how affordable credit is and whether some borrowers can build or rebuild financial lives after setbacks.

Financially savvy consumers may find value in understanding these shifts as they seek credit products. Keeping an eye on how your credit profile is constructed-and what newer forms of data might be included-can be useful. While no score is perfect, these emerging models represent an ongoing effort to align credit access more closely with actual financial behavior in today’s economy.

For a practical look at how some alternative data is assessed in credit scoring, sites like Experian’s overview of alternative data options provide useful insights. These explanations help demystify what kinds of information impact your chances when you apply for credit in the modern environment.

Ultimately, the picture remains complex. As credit scores become more nuanced, they can provide benefit and risk alike, depending on the user, lender, and context. The impact on borrowing capacity is real but depends on how widely these new models are embraced and how accurately they reflect each person’s financial reality.

Those paying close attention may find new opportunities opened, while others might encounter unfamiliar hurdles. Staying informed, reviewing credit reports regularly through major bureaus, and being attentive to how financial actions might influence evolving scores can help maintain control over borrowing potential.

Whether these scoring changes bring net improvement or new challenges will unfold gradually. Their emergence serves as a reminder that credit scoring is far from a fixed science. It is a dynamic system shaped continuously by data innovation, market needs, and social priorities.

Sources and Helpful Links

- Consumer Financial Protection Bureau on credit scores, explanation of key concepts behind credit scoring

- Experian alternative data overview, details on nontraditional credit information

- FICO credit score explanations, basics of traditional consumer credit scoring

- Consumer Reports on evolving credit scoring models, insight into changes and effects in the credit system