The quiet evolution beyond big bank shadows

Security concerns stay in the spotlight for banking, but most discussions focus either on the largest institutions or on fintech upstarts pushing innovation. Meanwhile, mid-sized banks occupy a quieter corner, yet their security efforts are evolving with care and practicality. These banks face the unique challenge of balancing nimbleness with compliance, and they do so while anchoring themselves firmly in communities that demand both trust and straightforward service.

Their regional or community-based customer focus intensifies the stakes. When breaches or fraud happen, the reputational damage is not abstract but felt on a personal level, often rippling through towns and neighborhoods. This means protecting customers cannot feel like a maze of obstacles or jargon. Instead, security protocols must be robust, but approachable. Creating a seamless line between safety and service has become a delicate task, requiring a deep understanding of both technology and the customer experience.

Security efforts by mid-sized banks must navigate regulatory mandates carefully while fostering customer confidence. Unlike large banks, which often have specialized security departments, these institutions tend to integrate security more closely with other functions, making adaptability and clear communication essential. The balance they strike can offer insights visible far beyond the communities they serve.

Blending established safeguards with emerging tech

Many mid-sized banks do not chase every new technology trend impulsively. Instead, they pick and choose tools that scale well and maintain ease of use. Multi-factor authentication has moved from novelty to standard, but institutions often look beyond this baseline as threats evolve.

The addition of behavior-based analytics has become a notable step in several institutions, helping detect suspicious activity through subtle patterns. For example, a login attempt from a foreign country or a sudden spike in transfers that does not fit usual customer activity can trigger automated checks or investigator review. This method helps avoid straining legitimate user access while catching fraud attempts early. An FDIC report underscores how layered security defenses reduce risk effectively without alienating customers, a balance these banks prioritize.

Alongside these digital tools, some mid-sized banks selectively deploy tokenization and encryption upgrades, especially on payment systems, where the risks of data interception still loom. Stronger encryption means that even if data is intercepted, it remains practically useless to criminals. Tokenization further secures payment cards by substituting sensitive data with surrogate tokens, reducing exposure during transactions.

This cautious but deliberate rate of adaptation reflects an intent to consolidate gains, not chase every shiny new feature that arrives on the market. Mid-sized banks tend to integrate technology with existing infrastructure thoughtfully, often piloting innovations before broader rollouts. This measured approach helps maintain system stability while upgrading core protections.

Personal connections shaping security choices

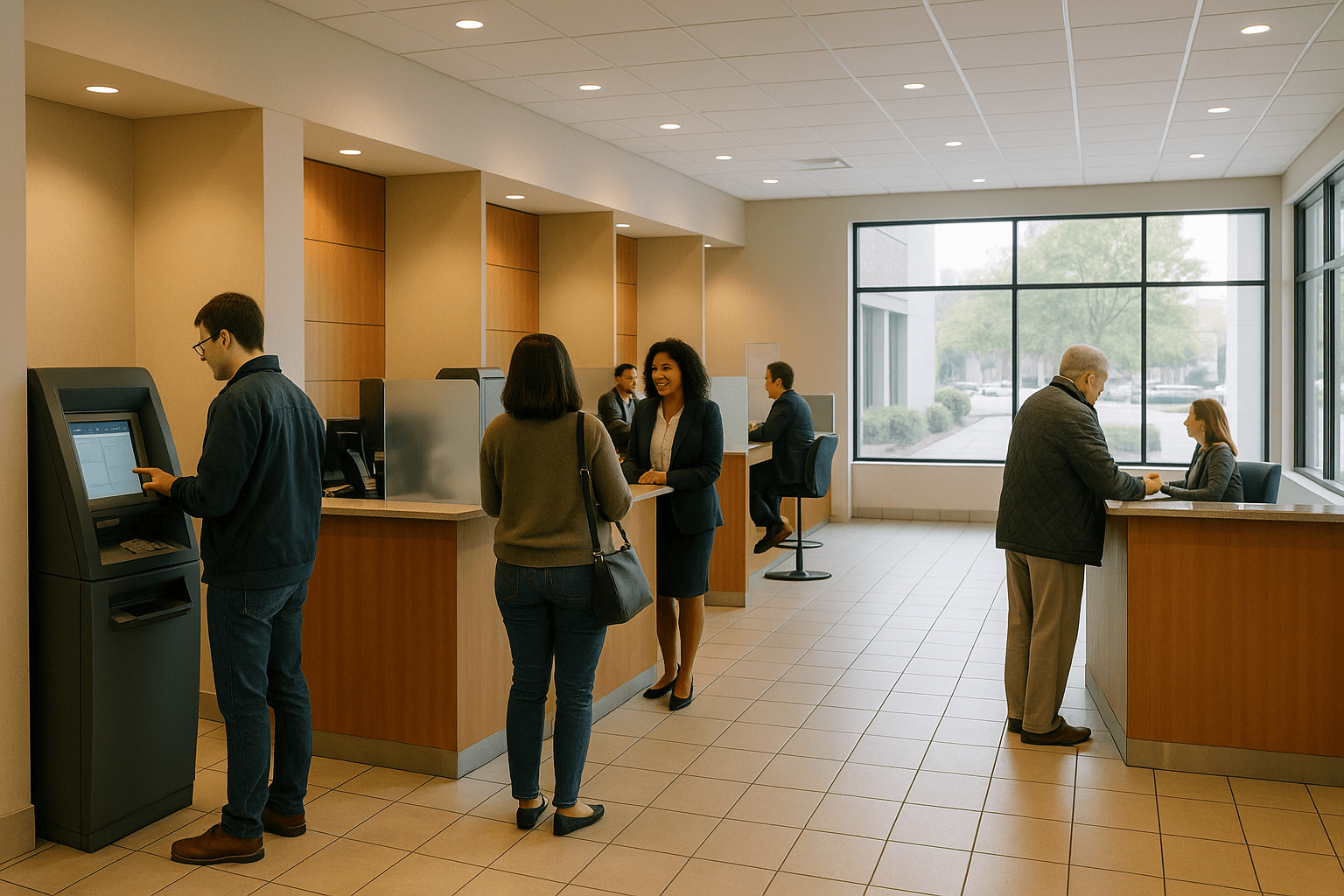

The personality of mid-sized banks often shows in security measures that include a human touch. Employees who know customers or at least their profiles can flag odd transactions for a quick conversation before action is taken. This familiar approach roots security in relationship, something larger banks struggle to replicate at mass scale.

When suspicious activity arises, staff members often reach out directly to customers. This contact can smooth over potential disruptions caused by fraud alerts and cut down on false positives that inconvenience users. The human element remains a vital complement to automated systems. Automated systems set alert thresholds, but local staff refine interpretation and resolution.

Maintaining this blend of technology and personal judgment embodies a longer tradition of banking where knowing your customer was not just compliance but community practice. This makes it easier for staff to step in when automated tools raise alerts. These conversations help confirm whether a transfer is expected or possibly fraudulent without unnecessary delay.

Of course, even with human oversight, the evolving sophistication of scams requires constant vigilance. Phishing attacks remain a significant threat, as documented by cybersecurity firms like Kaspersky. These scams often rely on tricking customers rather than breaking through technical defenses, emphasizing why institutions must pair tech upgrades with ongoing customer awareness efforts.

Educating customers becomes center stage

With close ties to local communities, mid-sized banks have ways to make security education feel less distant. Webinars, in-branch workshops, and mobile app reminders help keep customers aware of current fraud tactics. Unlike mass-market campaigns, these efforts can reflect regional trends or even business cycles affecting the area. This congruence raises engagement and relevance, making it more likely that notices about scam emails or suspicious calls are actually heeded.

Providing customers with straightforward resources supports stronger defenses on the front lines where breaches often begin. The Federal Trade Commission offers materials that banks adapt to share effectively. This emphasis on education speaks to a practical truth: no system can fully guard against human error, so reducing risk means helping customers recognize what to watch for everyday.

Beyond one-off alerts, some institutions are building security awareness into customer journeys. For example, when customers set up new accounts or update contact details, they might receive prompts about verifying identity safely. Notifications about unusual account activity often include reminders about phishing risks and careful password use. These subtle reinforcements build a mindset of vigilance over time.

Looking toward a future grounded in adaptability

For mid-sized banks, security investment is about more than compliance it is central to sustaining trust and relevance. Budget constraints require thoughtful choices, focusing on solutions that combine smart technology and human insight rather than broad expensive upgrades unsuited to their operational scale.

These banks are making strides by layering protections that adapt to changing threats and customer behavior. This can mean adding biometric options that work well with mobile app usage, tightening transaction monitoring, or improving encryption practices on digital banking platforms. Each step is measured and weighed, but it reflects a clear commitment to staying ahead of new cyber risks.

Biometric authentication such as fingerprint or facial recognition is becoming more accessible thanks to smartphone technology. Mid-sized banks find that adding biometrics can enhance security with little friction, blending convenience with safeguard. Combined with analytics, biometrics provide another hurdle for unauthorized access.

Ultimately, mid-sized banks illustrate that customer security is never a one-size-fits-all project. Success depends on assembling a mosaic of tools, people, and education calibrated for the communities served. It is a dynamic process, one that resists simple formulas and rewards those who pay close attention to how technology and trust intersect in everyday banking relationships. These banks remind us that security is as much about culture and communication as about code and devices.