When figures around consumer credit begin to shift, the story often reaches beyond simple borrowing decisions. The ebb and flow of credit balances, approval rates, and borrower profiles all speak quietly about how lending standards are adapting. Recent movements in this arena make it clear that lenders are navigating a complex environment with care, balancing risk with opportunity amid ongoing economic uncertainty.

The slow pulse of credit growth

In the last several years, consumer credit growth has taken on a more deliberate pace. Instead of rapid, unchecked expansions, lenders and borrowers alike appear more restrained. This tends to show up in credit card balances, auto financing, and personal loans as a more cautious approach becomes the norm. The surge in borrowing linked to pandemic relief payments and shifting spending habits eventually eased, signaling a time for recalibration.

This sobriety of growth partly stems from lenders tightening underwriting standards amid rising concerns about economic volatility and repayment capacity. The Federal Reserve’s reports reveal how banks are focusing more strictly on creditworthiness, evidenced by falling approval rates for new credit lines. These changes are not random but mirror wider caution as institutions weigh risks more carefully in their portfolios.

On top of the prudence on the lender side, borrowers themselves are showing restraint. With inflation swings and shifting job markets, individuals sometimes hesitate to expand their borrowing or take on new financial obligations without greater certainty about their incomes. This interplay between borrower caution and lender selectivity produces a credit market that grows slowly but with greater oversight.

Borrowers with stronger credit are becoming the norm

A notable trend in consumer credit is the shift in borrower profile. The average credit score of individuals who are newly approved for loans or credit cards has edged upward. This suggests lenders are more often extending credit to applicants with stronger credit histories. Looking at the Experian credit trends reinforces this, showing a rise in the average credit score of new cardholders and borrowers.

This tightening around quality is particularly evident in unsecured lending such as credit cards and personal loans. Meanwhile, auto lenders are focusing more than before on debt-to-income ratios and stable employment. These standards reflect an awareness of the pressures many households face today, managing inflation, rent increases, and an occasionally volatile labor market.

Another dimension is how lenders incorporate regulatory advice, which often encourages maintaining prudent underwriting standards that balance credit availability with risk containment. The presence of stricter documentation and verification processes is a tangible sign of this attitude.

Patterns in credit utilization and payment behavior

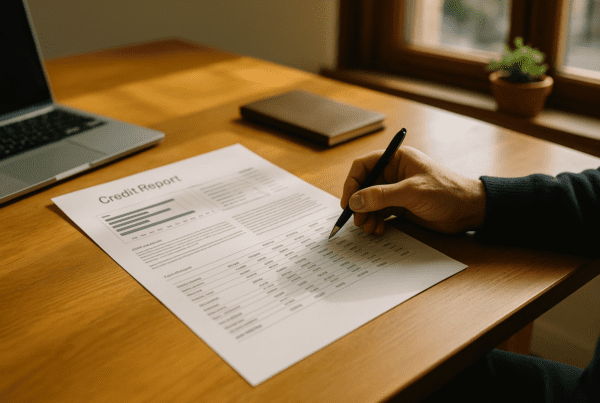

Looking beyond who gets credit and how much, the ongoing management of existing debt offers additional clues. Credit utilization, which compares the amount of credit used to total available credit, tends to be a bellwether of consumer financial health. Today, utilization metrics suggest many borrowers are exercising restraint, keeping balances moderate rather than maxing out available lines.

This controlled use points away from reckless or stress-driven borrowing, providing some comfort to lenders who look for signs of strain. Payment patterns add a further layer of insight. Delinquency rates, especially for recent missed payments, are mostly stable but with some increases in unsecured credit. This nuanced picture suggests that while many households are managing their debts responsibly, pressures remain that challenge certain groups.

The TransUnion quarterly credit reports highlight these ongoing dynamics, underlining the connection between economic conditions, consumer resilience, and credit risk. Local or sector-specific factors may influence these behaviors, adding to the complexity of interpreting credit data.

The evolving story of lending standards

Piecing together these trends paints a picture of lending standards in motion rather than frozen in place. The cautious approach to credit supply, the uptick in credit quality among new borrowers, and the stable yet occasionally challenged repayment landscape all point to a credit market adapting to uncertainty.

Risk management appears paramount. After recent volatility, including pandemic-related defaults and inflation’s impact on budgets, lenders are recycling capital with more selectivity. This prudence, while tightening access for some, is a way to maintain financial system stability and control loss rates. It is a trade-off that reflects the realities of balancing growth with risk mitigation.

The credit market today also shows signs of heterogeneity. Certain lenders innovate with alternative credit data or finely tuned risk models that can open doors for borrowers who fall outside traditional scoring criteria. These developments suggest a multi-layered environment in which not every consumer faces credit restrictions in the same way.

Looking at credit outcomes over time, it becomes clear that lending is not simply more difficult across the board but is evolving with economic conditions while still aiming to provide credit to those who prove prudent financial management.

For those watching their own borrowing options or planning major financial moves, understanding this context offers some clarity. Keeping up with credit reports, approval trends, and payment behavior helps make better-informed decisions and sets more realistic expectations about the credit landscape.

While the pace of credit growth may feel slower than before, this period points to a market that is finding a new balance. It weighs opportunity against risk, incorporates lessons from recent disruptions, and cautiously extends credit where it seems most sustainable. In doing so, it reveals lending standards that respond to the lived realities of both lenders and borrowers.

As the future unfolds, ongoing monitoring of authoritative sources and credit data will remain key to recognizing shifts and preparing for what lies ahead in consumer credit markets.

Sources and Helpful Links

- Federal Reserve Monetary Policy Reports, overview of central bank insights on credit conditions

- Experian Credit Statistics, consumer credit score and debt data

- TransUnion Quarterly Credit Industry Insights, trends in delinquencies and credit utilization