Insurance claims involving real estate have quietly charted the shifting landscape where nature’s forces press against human settlements. With climate change intensifying weather extremes, these claims now do more than just tally losses. They sketch an evolving map of vulnerability that spans flooding, wildfire damage, fierce storms, and other natural hazards. Looking beneath the surface of these numbers unpacks how climate risk patterns are affecting homes and communities in tangible and lasting ways.

More Than Numbers in a Ledger

Insurance claims might appear to be just numerical records of payouts, but they tell a deeper story about the evolving climate challenges people face. In the United States, data collected by the National Association of Insurance Commissioners shows that some types of claims have risen steadily in certain regions over recent decades. Coastal and floodplain areas have seen a consistent uptick in flood and wind damage claims, mirroring the increasing severity of storms and rising sea levels. The western U.S., on the other hand, experiences a surge of wildfire claims linked to extended droughts and longer fire seasons, especially in states such as California and Oregon.

This data does more than highlight physical hazards. It reflects the economic and social ripple effects as well. For instance, when risks increase in a neighborhood, insurance companies often raise premiums or withdraw coverage altogether. This can reshape real estate markets, influence where developers choose to build, and alter homeowners’ decisions about staying or moving. Insurance claims thus become a barometer of both environmental and financial stresses on communities.

Flooding’s Rising Toll on Homes

Flood damage remains one of the most persistent and costly threats linked to climate shifts. The Federal Emergency Management Agency’s National Flood Insurance Program reports that storm-related flooding has led to a notable increase in insurance claims. Many urban areas face serious challenges because rain soaks surfaces that cannot absorb water easily, overwhelming storm drains. Basements fill, foundations weaken, and repairs often stretch into the tens of thousands of dollars.

One persistent issue is that flood risk maps often lag behind current realities. Neighborhoods once considered safe may experience flooding due to changing rainfall patterns or urban growth that affects drainage. This mismatch appears in claim data when traditionally low-risk areas suddenly report more flood damage. It pushes insurers to rethink how coverage is priced and how risk is assessed, though changes sometimes come slowly compared to how rapidly conditions evolve.

Wildfires and the Long Shadow on Property

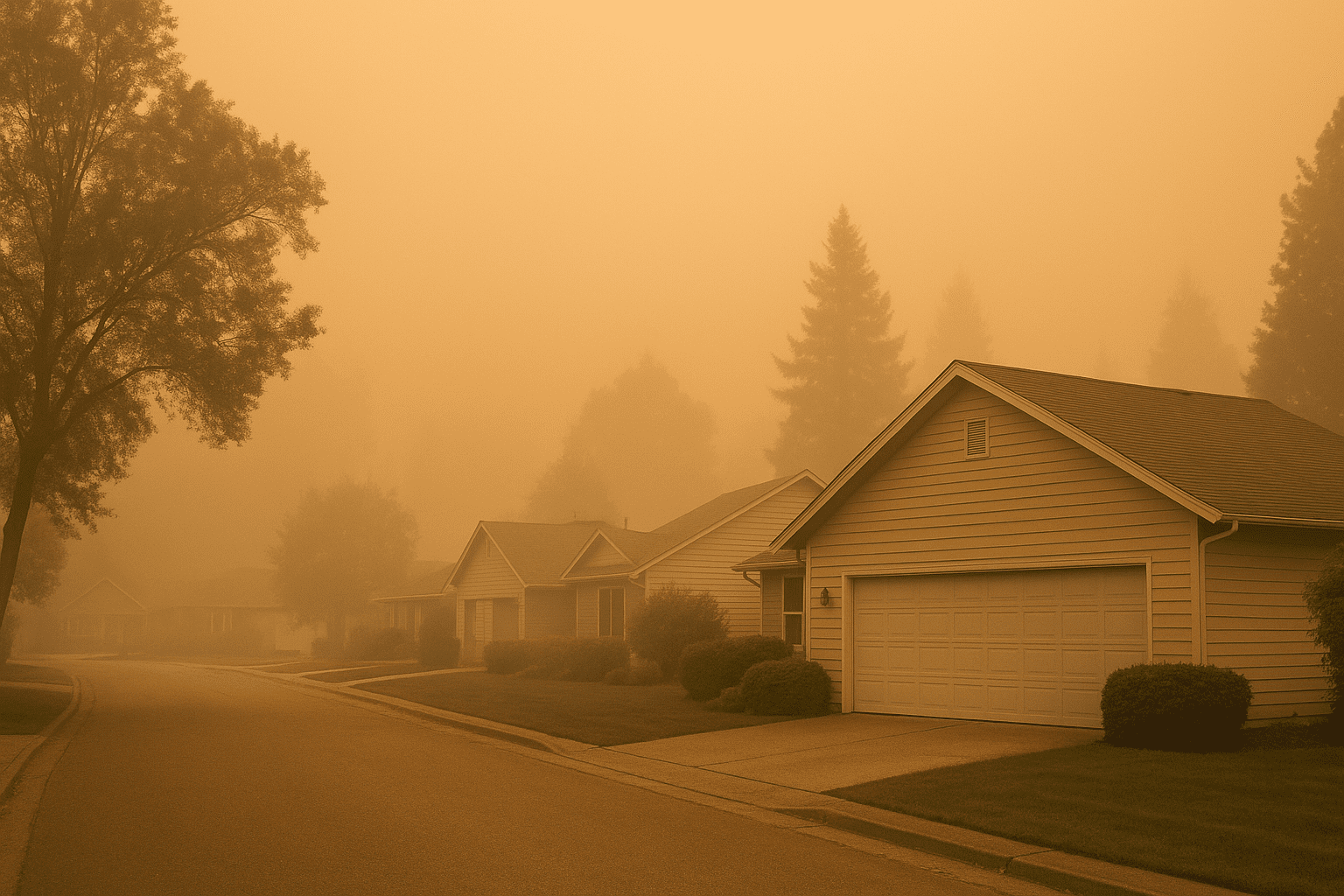

In America’s western states, insurance claims reveal a troubling picture of housing vulnerability to wildfires. Hotter, drier conditions and expanded drought zones have prolonged fire seasons, with communities in California, Colorado, and the Pacific Northwest bearing the brunt. Claims rise sharply after fire events, but their impact lingers much longer. Property values drop in fire-prone areas, and the cost or availability of insurance coverage tightens as insurers account for escalating risks.

Insurance companies have started to integrate climate science more deeply into underwriting decisions, but ongoing increases in wildfire-related claims signal a complex challenge. Some homeowners rebuild with more fire-resistant materials, while others face difficult choices about relocation or accepting higher insurance costs. The interplay between insurance data and climate conditions is prompting fresh discussions about land use, community planning, and resilience measures.

The Complex Reach of Storm and Wind Damage

Storms remain a major driver of insurance claims across a wide swath of the U.S. The Gulf Coast regularly experiences hurricanes, while inland regions report damage from tornadoes and intense wind events. These claims often spike suddenly following a storm, stretching insurance companies’ resources and pushing premiums upward in affected zones.

Tracking trends in storm claims shows growing variability, partly due to climate change influencing storm patterns and intensities. As storms grow stronger or shift in frequency, insurers face more uncertainty in predicting exposure. This challenges risk management and heightens concerns about the shrinking availability of coverage in some high-risk areas. The notion of insurance deserts has emerged where homeowners find fewer options or unaffordable rates.

The Stories Claims Data Tell About a Changing Climate

Real estate insurance claims serve as a prism reflecting how climate risk is increasingly embedded in everyday decisions about property ownership. What emerges is a complex picture of weather events intersecting with local vulnerabilities, economic pressures, and evolving human responses. Thousands of claims – from minor structural fixes to total losses – accumulate into signals about where and how risks are intensifying.

While no dataset alone can fully predict future outcomes, insurance claims are a tangible indicator of how floods, wildfires, and storms are encroaching on what once seemed stable ground. They provide regulators, insurers, and communities with critical insights to guide new approaches to land use, building codes, and insurance models. Homeowners benefit from understanding this landscape, as it shapes the protection available for their most valuable assets.

Ultimately, these claims form more than just a financial ledger. They become an archive of the dynamic and sometimes fragile relationship between climate and homeownership. As the environment shifts, the lessons from insurance claims about exposure and resilience will only become more vital to grasp.

Sources and Helpful Links

- National Association of Insurance Commissioners, insurance regulation and consumer resources

- FEMA National Flood Insurance Program, details on flood insurance data and coverage

- Insurance Information Institute on Wildfire Coverage, explaining wildfire risks and insurance responses

- NOAA Climate Monitoring, overview of climate trends affecting storm and drought risks