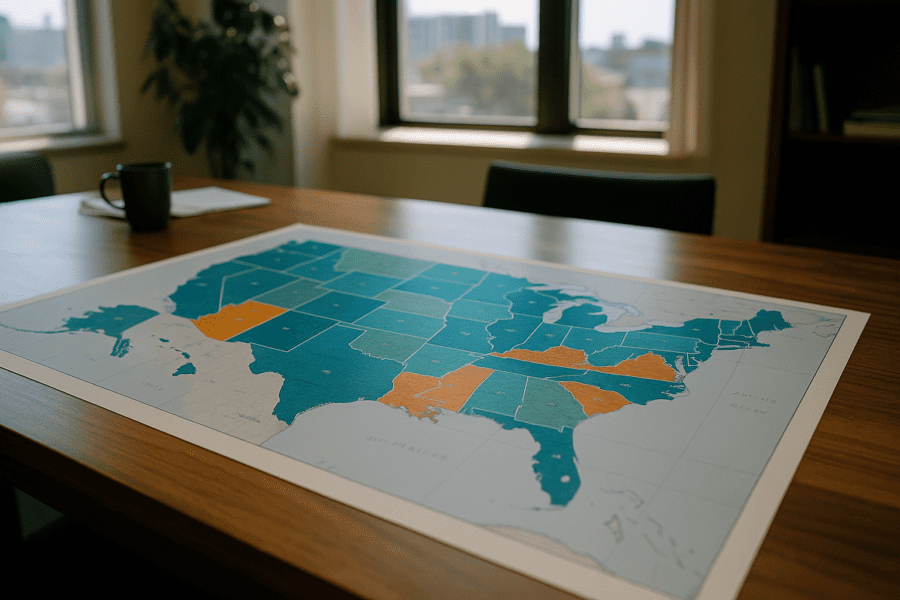

Health insurance enrollment is often viewed through national-level statistics that show coverage rates or uninsured percentages for the country as a whole. Yet, once you start looking closer at regional differences, the picture becomes more complex. Different parts of the country reveal distinct enrollment patterns shaped by local economies, policy decisions, cultural attitudes, and demographics. These patterns influence not only how many people have insurance but also what kind of coverage they have and how consistent it is over time.

Where You Live Shapes What Coverage Looks Like

When examining health insurance data, it quickly becomes clear that the Northeast and West Coast tend to have higher enrollment rates in government programs like Medicaid. This contrasts with certain parts of the South and interior West where enrollment may lag behind national averages. For example, states that chose not to expand Medicaid under the Affordable Care Act (ACA) often see gaps in coverage among lower-income residents. In regions with Medicaid expansion, more people qualify for low-cost or no-cost coverage, which pushes overall enrollment higher.

Local economic conditions play a role too. Areas with more employers offering health benefits typically have higher employer-sponsored insurance enrollment. Urban centers with larger job markets and diverse industries are more likely to have employers providing comprehensive plans. Rural regions, in contrast, sometimes face challenges with fewer employers offering benefits, leading to higher reliance on government programs or uninsured status. The Census Bureau’s health insurance data give insight into these geographical divides, showing how state policies and economic factors intertwine.

Individual Markets and Regional Nuance

The ACA marketplaces present another layer of variation. These platforms, where individuals can shop for private coverage often with income-based subsidies, have uneven participation rates by region. In some Northeastern and Western states with actively managed marketplaces and aggressive outreach efforts, enrollment numbers are robust. In others, particularly where outreach is minimal or state support is limited, enrollment struggles.

Moreover, the choice of insurers in marketplaces often differs. Some regions have multiple competing insurers, offering a variety of plans across different tiers of coverage and cost. Other areas may have only one insurer participating, reducing options and sometimes leading to higher premiums. This variation affects consumer behavior, since fewer choices can discourage enrollment or push people toward less ideal plans.

State and local regulations further complicate this picture. For example, some states have adopted additional consumer protections or mandate certain coverages that increase plan appeal. In contrast, states with fewer mandates may see more affordable plans but potentially less comprehensive coverage. These differences underscore how regional governance shapes what insurance really looks like on the ground, beyond broad national statistics.

Demographics and Cultural Attitudes Affecting Enrollment

Given the diversity of the American population, demographics naturally impact health insurance enrollment patterns. Younger adults, who generally use fewer health services, often choose to remain uninsured or opt for minimal coverage. Regions with larger young populations, such as college towns or rapidly growing metro areas, may reflect this trend in the data.

Cultural perspectives on health care and insurance also influence enrollment. Areas where there is skepticism about government programs may see lower participation in Medicaid or marketplace plans, even when eligible. Language barriers, immigration status, and familiarity with insurance systems further complicate access and enrollment in certain communities. Trusted local organizations and outreach programs can sometimes overcome these hurdles but success varies widely.

This dynamic is visible in state-by-state variation for the uninsured rate and in enrollment among immigrant communities. The Kaiser Family Foundation’s Medicaid enrollment data provide a window into how these trends play out, showing gaps in coverage tied to demographic factors and policy environments.

What This Means for Access to Care

Enrollment patterns shape not only who has insurance but also how effectively they can obtain health care. In regions with high enrollment and broad coverage options, access to primary and specialty care tends to be more steady. In contrast, areas with lower enrollment or narrower provider networks may experience gaps in care, higher out-of-pocket costs, or delays in treatment.

Moreover, coverage stability is crucial for ongoing health management. People in regions where insurance churn is common-shifting in and out of coverage due to income fluctuations or eligibility changes-might struggle to maintain continuous care. Understanding regional enrollment patterns helps explain why health outcomes and cost burdens vary across the country.

The connection between policy, economy, and culture seen through these enrollment patterns emphasizes the complexity behind the surface numbers. No single factor dictates coverage outcomes; instead, a tangle of local realities interact to form the enrollment landscape. For consumers, workers, and policymakers alike, grasping this context offers a clearer picture of the challenges and opportunities in making coverage more widespread and equitable.

As health insurance continues evolving with economic shifts and political changes, these regional distinctions will remain a key piece in understanding how the system functions day-to-day for millions. By paying attention to the details in enrollment patterns, stakeholders can better address gaps and design programs tailored to the real conditions people face.

For more in-depth information on health insurance enrollment and policy impacts by state, resources like the Centers for Medicare and Medicaid Services marketplace reports offer regularly updated data and analysis.

This gradual layering of insight-from national trends down to regional, demographic, and policy nuances-illuminates how enrollment patterns are more than just numbers. They reflect the lived experience of health insurance access across a varied and changing landscape.

Sources and Helpful Links

- Census Bureau Health Insurance Data, detailed enrollment statistics by state and region

- Kaiser Family Foundation Medicaid Enrollment, state-level Medicaid coverage insights

- CMS Marketplace Data, reports and analysis of ACA marketplace enrollment