When economies begin to recover from downturns, businesses often find themselves taking a closer look at their insurance policies. It is not unusual for companies to reassess coverage as the landscape of risks and opportunities transforms alongside economic shifts. This cycle of reevaluation reflects more than just changes in balance sheets. It reveals how businesses respond in real time to new realities, weighing the protections they need against evolving threats and operational shifts.

The subtle signals prompting renewed scrutiny

Economic recovery often brings a complex mixture of optimism and caution. Companies expanding operations or investing cautiously in uncertain markets tend to revisit legacy assumptions embedded in their insurance policies. For some, growth means exposure to new types of risk not fully accounted for in earlier policies, such as an uptick in supply chain disruptions or changes in workforce structure. For others, the slow aftereffects of previous recessionary pressures create gaps in coverage that suddenly feel significant.

Moreover, inflation can quietly undermine the value of existing policies. Limits and coverage amounts set before an economic shift may not reflect the true cost of replacement or repair today. This discrepancy pushes businesses to update their policies to avoid blindsiding financial losses. At the same time, insurers themselves may adjust premium structures or coverage terms in response to broader economic indicators, transferring some of the risk back to policyholders.

How operational changes reveal coverage gaps

During recovery, businesses often tweak operations in ways that can directly affect insurance needs. For example, remote work, which many adopted during a downturn, can continue in hybrid forms, altering liability and property exposure. Warehousing and logistics patterns might shift as companies seek to improve resilience, changing the risk profile of assets and transit.

Such operational shifts frequently expose blind spots in policies. Cybersecurity coverage has become more prominent as digital vulnerabilities gain traction. Liability clauses tied to new product lines or service models may require revision. Even changes in employee roles or benefit structures prompt a review of workers compensation policies. Businesses that postpone these reviews risk facing claims that their insurance does not fully cover.

The role of insurers and evolving risk models

Insurers themselves are not passive players in this process. They continuously refine underwriting approaches, using data analytics and evolving risk models influenced by shifting economic and social conditions. For instance, many are reassessing environmental risk, supply chain fragility, and emerging legal landscapes to better forecast potential claims. This dynamic often leads to adjustments in policy offerings, premiums, or conditions that businesses must stay alert to.

Some carriers have become more selective with whom they insure or the types of risks they accept. This tightening affects availability and affordability for certain sectors, especially those deemed higher risk in the new economy. Businesses caught unaware may find that renewing a policy under old terms is no longer feasible, prompting a more detailed negotiation or a search for alternative coverage.

Preparing for unexpected disruptions amid recovery

Even as recovery progresses, uncertainty remains. Natural disasters, geopolitical tensions, and shifts in consumer behavior can introduce sudden shocks. Insurance policies built during more stable times may not fully anticipate these evolving vectors. As a result, businesses often take this period to consider contingency coverage or increase limits on critical protections.

In practical terms, this might mean adding more comprehensive business interruption insurance, extending product liability clauses, or incorporating broader cyber risk policies. The goal is to build resilience. Insurance, in this view, becomes part of a broader risk management strategy rather than just a reactive measure.

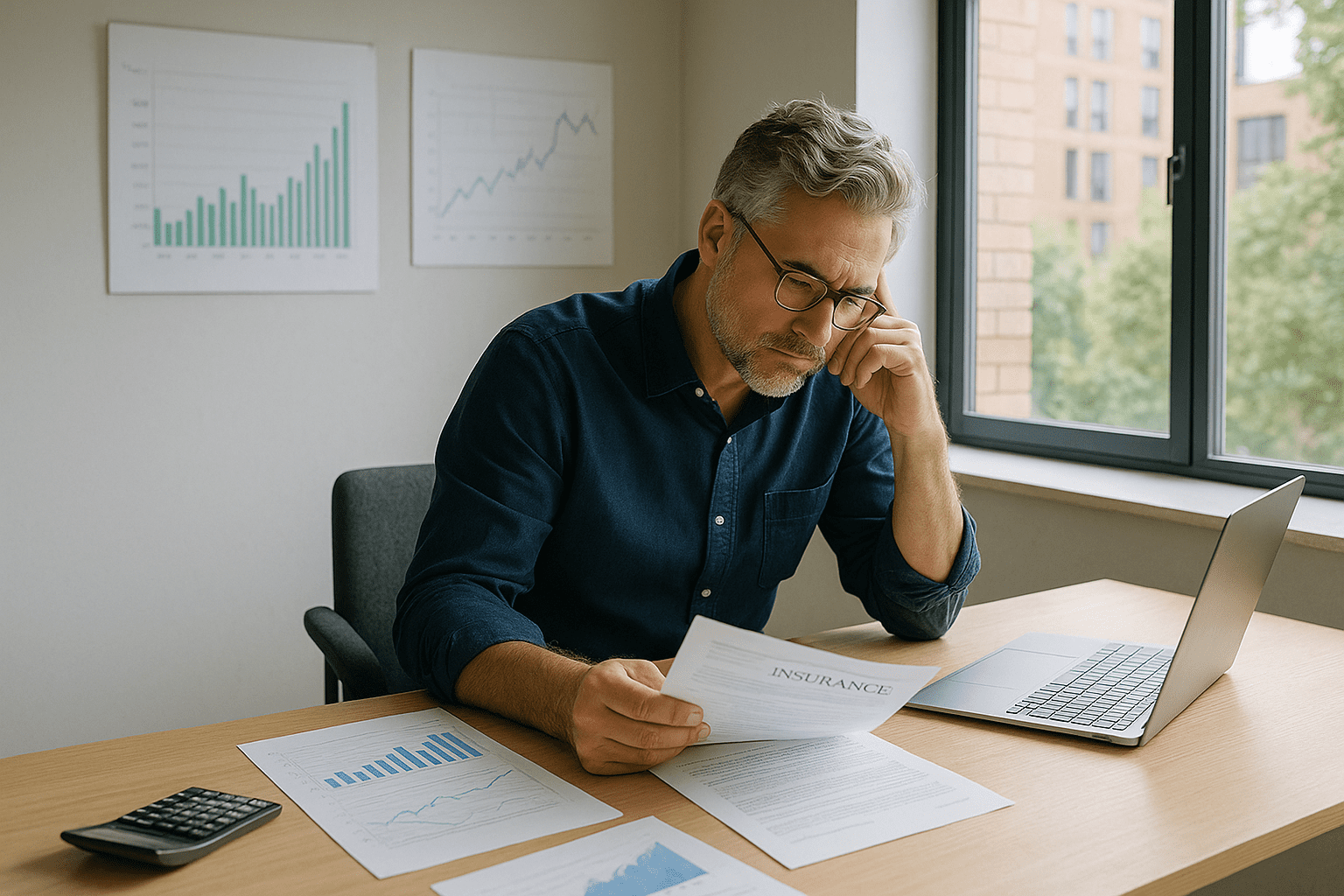

Real-world decisions and the need for clear communication

Business owners and managers often describe the reconsideration of insurance as a balancing act. They must weigh the cost of more extensive coverage against tight budgets and competing priorities. Yet, many also acknowledge the value of clearer understanding and communication with insurance providers. Reviewing policies is not just about ticking a box; it is about unpacking complex terms and adjusting expectations.

This process is particularly important because the language of insurance can feel opaque. Grappling with exclusions, riders, and conditions that change or become more restrictive can be daunting. Clear communication helps avoid surprises and reinforces the purpose of insurance as a safety net tailored to a company’s current needs.

Some businesses engage brokerage expertise or specialized consultants during this phase, viewing the investment as insurance against insurance pitfalls. The complexity and stakes involved often make that practical sense, fostering a more strategic approach to coverage that supports long-term stability.

In the end, reevaluating business insurance during economic recovery is a natural reflection of shifting realities. It underscores how insurance, rather than a static contract, is a living part of how businesses engage with risk and opportunity. For companies that navigate this thoughtfully, it can be a cornerstone of resilience as they chart their path forward.

Understanding the nuances behind these changes offers insight into both the challenges and preparations businesses face beyond headlines about growth or optimism. Insurance policy reviews are, in many ways, a mirror reflecting broader economic and operational transformations, emphasizing the importance of adaptability in a recovering environment.

For those interested, resources like the Insurance Information Institute provide ongoing updates and explanations tailored for businesses. Additionally, the National Association of Insurance Commissioners offers detailed guidance on market conduct and policyholder protections. Exploring these sources can help businesses approach insurance reviews with grounded knowledge rather than uncertainty.

The evolving landscape also highlights how important it is for business leaders to maintain a close, transparent relationship with their insurance providers. Staying informed about policy adjustments amid economic shifts facilitates better decisions that align with current realities, avoiding surprises that can come from outdated coverage assumptions.

Ultimately, while the process might feel complex or costly in the short term, it is an integral part of how companies adapt to changing risk environments. Insurance policies need to reflect what businesses are doing now, not just what they did in more stable times. This recalibration supports sensible risk management and contributes to smoother recovery trajectories across varied industries.

As economies continue to evolve, so too will the interplay between business needs and insurance provisions. That ongoing dance is one that rewards attentive listening and thoughtful action in equal measure.

There is no one-size-fits-all solution, but recognizing that insurance policies are living documents helps demystify their roles during economic recovery and beyond.

Businesses willing to embrace this perspective may find themselves better positioned to face inevitable uncertainties with a measure of confidence supported by practical protections.

More information about changes in business insurance during economic shifts can be found through established industry analyses at Business Insurance, which tracks market trends, claims performance, and regulatory responses relevant to this ongoing process.

Sources and Helpful Links

- Insurance Information Institute, ongoing insurance insights for businesses and consumers

- National Association of Insurance Commissioners, regulator guidance and policyholder protection

- Business Insurance, industry news and analysis