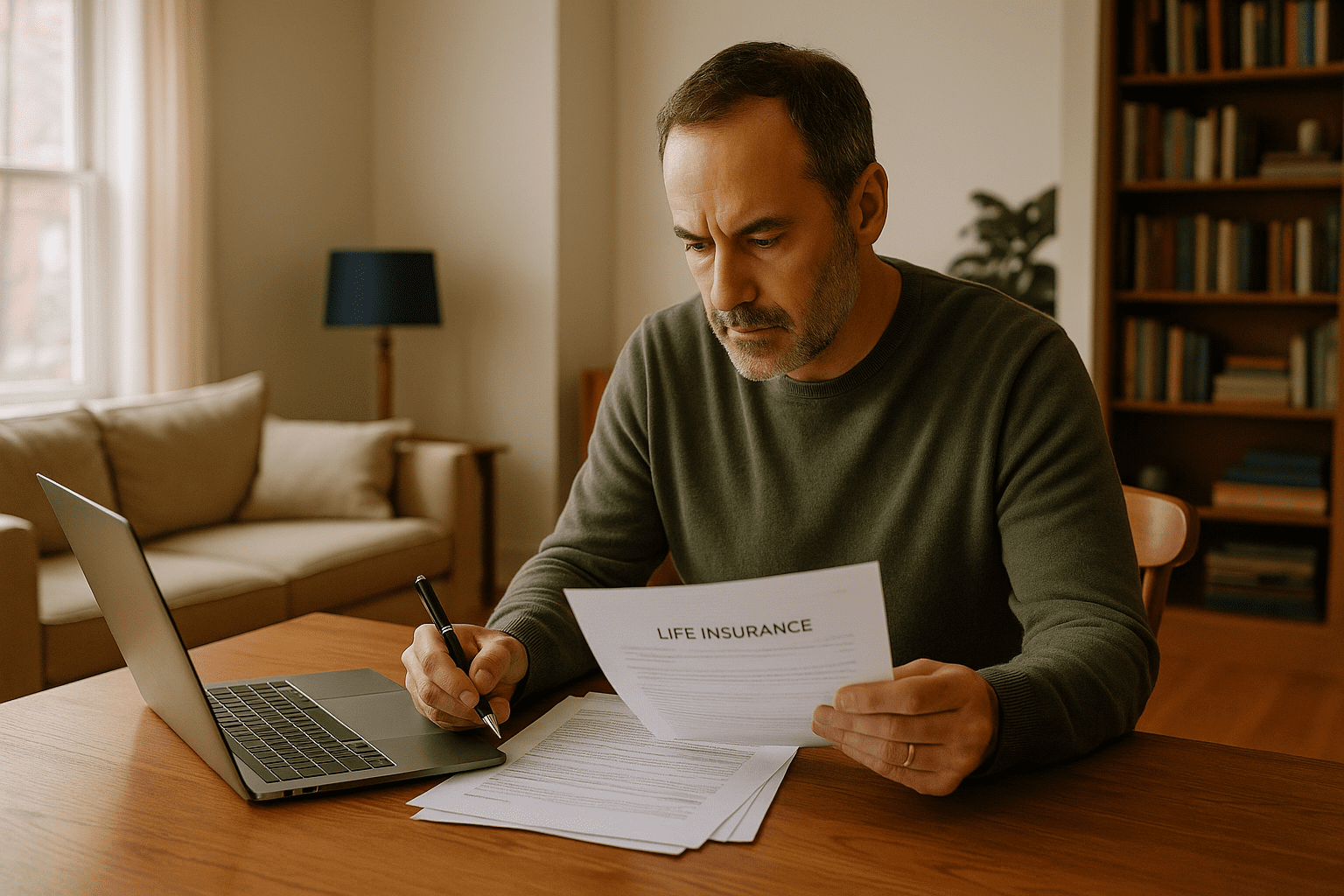

Life insurance often carries weight beyond finances. For many, it is a quiet pledge to family, a buffer against eventful uncertainties, and sometimes simply a part of ongoing financial routines. But when premiums rise or coverage shifts, those quiet commitments surface in varied ways, revealing how individuals really live with and value life insurance.

The tug when premiums go up

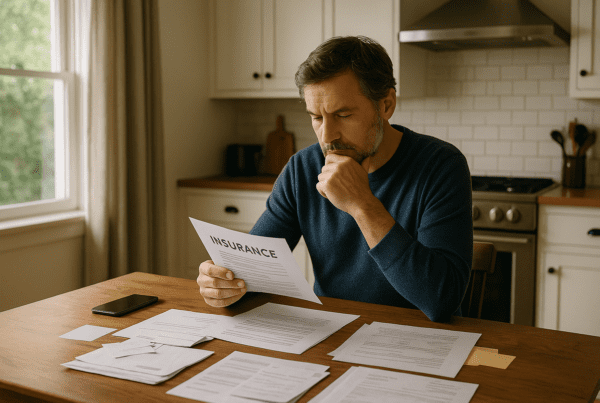

Premium increases pop up regularly as insurers reassess risks, respond to broader market movements, or adjust to regulatory changes. This is hardly news to those working in finance, yet for everyday consumers, it lands more unevenly. Some accept the changes without much fuss. They see the coverage as essential and nonnegotiable. For them, rising costs are simply part of the deal, an investment in peace of mind.

But for others, an increase in premiums prompts a pause. It starts a search for alternatives or a reassessment of what the policy really means. Money is an obvious factor, but not the only one. An older adult living on a fixed income might feel the strain more acutely, launching a financial dilemma that includes tough choices. Meanwhile, younger policyholders, perhaps with expanding families, may grudgingly accept the rise as the price for safeguarding loved ones.

Several consumer studies suggest that people who have actively engaged with their life insurance feel better prepared to absorb premium increases. They are more likely to view these as manageable tradeoffs, linked to solid understanding of coverage worth. On the other hand, those holding older policies out of habit or old advice might see premium hikes as triggers to let protection lapse or reduce coverage.

Shifts in what the policy actually covers

When insurers alter terms or benefits, the impact sometimes runs deeper than the price tag. Modifications might reflect attempts to keep pricing sustainable or meet regulatory expectations, but the ripple effects on policyholders can be profound.

Imagine a situation where benefits linked to events like accidental death or illness-related payouts are narrowed or removed. Such changes, often buried in dense paperwork, reshape aspirations of safety and security. For policyholders, the contract begins to feel less like a guarantee and more like a moving target.

Many individuals hesitate to act immediately, hoping that their coverage still stands for what it originally meant. This hesitation speaks to how life insurance often carries emotional weight. It can serve as a mental anchor in unpredictable times. Some consumers reach out to insurers or agents to clarify terms or negotiate options, though this success is uneven and sometimes hampered by company policies or rigid fine print.

Reconsidering coverage and exploring new paths

Changes in premium costs or coverage usually prompt some consumers to shop around. The proliferation of digital tools and comparison websites has made this easier than ever before, empowering people to be more proactive about their protection. These resources allow for more accessible second opinions and reveal new products tailored to shifting needs or budgets.

These efforts lead to varied outcomes. Some opt for term life insurance, attracted by lower upfront costs and simplicity, instead of whole life options that build cash value but may cost more. Others adjust coverage amounts to better match their current circumstances or bundle policies to seek discounts. Each decision reflects a negotiation between financial realities, comfort levels, and preferences for certain risk management approaches.

At the same time, for some, the combined pressure of cost increases and confusing policy changes creates friction strong enough to push them away entirely. Lapsed policies relieve immediate budget stress but may generate questions about future resilience if the unexpected happens. This situation highlights the delicate balance between managing everyday finances and maintaining long-term protection.

The unspoken role of communication and trust

How insurance companies and representatives handle communication during premium increases or coverage adjustments often shapes consumer reactions more than the changes themselves. Clear explanations that link premium updates to health trends, market conditions, or regulatory demands help foster understanding and patience. They reassure policyholders that changes are not arbitrary but grounded in real factors.

On the other hand, notices filled with jargon or vague language tend to alienate consumers. When people struggle to decipher what is happening, they feel overlooked or mistrustful, which sometimes leads to canceled policies or sour relationships with insurers.

This dynamic reveals that life insurance exists not just on paper but through ongoing interactions. The quality of agent-consumer relationships and the accessibility of information strongly influence whether coverage continues or ends. Trust and transparency become as important as the financial terms.

Watching consumer responses to life insurance premium and coverage changes reminds us we are dealing with more than numbers. These financial products reflect hopes, fears, and trust in the face of life’s uncertainties, a mix as human as it is economic.

The varied ways people engage, adjust, or step away unveil a range of attitudes about financial security and how the shifting terrain of cost and coverage is navigated over time.

Sources and Helpful Links

- Consumer Financial Protection Bureau Life Insurance Guide, practical information about life insurance policies and consumer rights.

- National Association of Insurance Commissioners, regulator information and consumer protection resources for life insurance.

- Kaiser Family Foundation Life Insurance Overview, research and data on life insurance coverage and trends.

- Insurance Information Institute on Life Insurance Premiums, how premiums are calculated and adjusted over time.