When economic stability wavers, financial protections that once seemed distant can suddenly feel pressing. Disability insurance is one of those protections that often slips under the radar until life presents a challenge. Increasingly, subtle shifts in how people approach this coverage have emerged alongside economic uncertainty. These shifts capture more than simple risk aversion. They reveal a complex interplay of income volatility, evolving work habits, and fresh attitudes toward long-term financial security.

The quiet recalibration of defense against unpredictability

Financial turbulence, whether triggered by inflation worries, labor market shifts, or global disruptions, nudges many toward looking beyond day-to-day budgeting and into how unforeseen setbacks might affect them. Disability insurance has long served as a safety net to replace income in difficult times, but recent trends suggest it is becoming an area of active engagement for a broader set of people. This is not merely new policy sales; it is also about adjusting existing plans to better fit current realities.

Industry voices and data sources, including LIMRA and the Council for Disability Awareness, report more inquiries and stronger retention despite economic headwinds. Some workers renew coverage more diligently, others revise their plans to include features that were less common before, such as partial disability coverage or flexible premium arrangements. The collective mood behind these moves reflects a heightened awareness that economic fragility is now more of a lived experience than an abstract possibility.

Looking closer: who is adjusting their coverage and why

The tapestry of today’s disability insurance consumers is more varied and nuanced than earlier chapters of coverage norms. Younger workers-especially those balancing gig work, freelance projects, or contract-based income-are moving from casual curiosity to serious consideration. The irregularity of their earnings exposes them to vulnerabilities that traditional income protections did not fully address in the past. To these workers, disability insurance is less about distant worries and more about filling immediate gaps that could emerge if illness or injury disrupts their ability to earn.

On the other hand, older employees near retirement are examining their coverage with new eyes. Some are bolstering their safeguards, acknowledging that even short-term disabilities can have outsized effects on their retirement planning. Others, facing tighter budgets or shifting priorities after economic shocks, trim benefits or select riders that better align with their projected needs. This careful recalibration demonstrates that disability insurance now intersects with a range of financial goals, not just emergency response.

Beyond age groups, employer-based group plans and individual policies see different dynamics but share a common thread: a more sophisticated balancing of cost, protection, and perceived risk. For many, these adjustments come from lived encounters with economic unpredictability and evolving workplace realities rather than from marketing or anecdotal advice.

Insurance products evolving with the times

Responding to evolving consumer behavior, insurance providers have introduced policy features that blend flexibility with clarity. Temporary adjustments to coverage, options for partial payouts, and recovery-related support add layers of nuance to how disability insurance can work in real life. These adaptations recognize the different forms and durations of disability that people face, rather than a one-size-fits-all approach.

The rise of digital insurance platforms also deserves mention. Applications, policy management, and customer service available online reduce friction and invite ongoing interaction with coverage. Policyholders can experiment with adjustments, pause and restart riders, or update beneficiary details with less hassle than before. This digital accessibility matches the rhythm of contemporary financial life, especially for those juggling irregular schedules or multiple income sources.

Financial resilience in a workplace that keeps on shifting

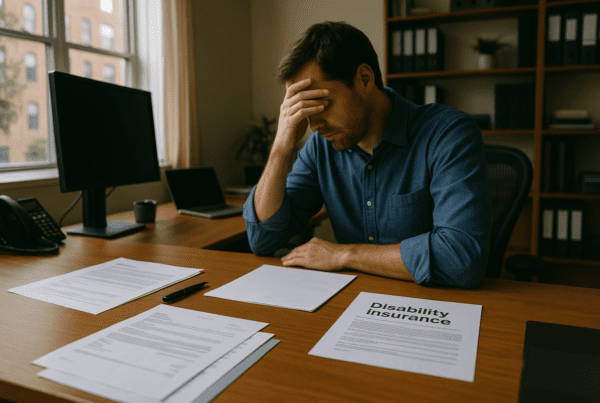

Disability insurance behavior connects to broader trends in how people approach financial resilience. The emerging contours of the labor market, with increasing freelance and contract work, blend with persistent concerns about healthcare affordability and gaps in government safety nets. Although programs like Social Security Disability Insurance provide a foundation, their waiting periods and eligibility rules often make private or employer coverage crucial to bridging income loss quickly and effectively.

Such gaps are not just technical details; they shape the lived experience of workers, nudging many toward revisiting or initiating coverage decisions they once postponed. The public dialogue around social safety nets reinforces the perception that disability insurance, far from being a luxury, is a practical tool for long-term financial stability.

Understanding these connections reveals why disability insurance moves respond to more than the immediate health landscape. They speak to deeper concerns about control and preparedness in an economy that seems increasingly unpredictable.

For individuals taking stock during economic uncertainty, seeing disability insurance through this wider lens encourages a more grounded approach. Coverage decisions become not just about policy details but about fitting income protection into the fabric of one’s broader financial life.

In this way, the patterns of change in disability insurance uptake reflect how people maneuver through economic fragility with thoughtful caution and flexible strategies. Observing these developments is key to grasping how financial behavior adapts under pressure and how insurance products evolve to meet those shifts.

Keeping track of reports and updates from trusted institutions like the Council for Disability Awareness and LIMRA offers ongoing insight into these financial currents. Meanwhile, understanding the role of federal programs such as Social Security Disability Insurance helps frame coverage choices within the larger system of protection. Consumer information from the Consumer Financial Protection Bureau adds clarity for those wrestling with options and rights.

This evolving interplay underscores a pragmatic shift among consumers: viewing income protection through a lens shaped by real economic conditions, workplace trends, and individual risk perceptions rather than only actuarial models or standard sales pitches. This understanding speaks not just to insurance markets but to the quiet, ongoing recalibrations households make as they navigate an unpredictable world.

Sources and Helpful Links

- Council for Disability Awareness, information on trends and statistics in disability insurance

- LIMRA Research, market insights and data on insurance product uptake

- Social Security Disability Insurance (SSDI), official government page outlining federal benefits

- Consumer Financial Protection Bureau, guidance on insurance basics and consumer rights